Sovereign risk after COVID-19: Don’t forget domestic debt

30 October 2020

The sharp reductions in economic output and large-scale government expenditures prompted by the COVID-19 pandemic have led to an enhanced risk of sovereign defaults, especially in emerging economies.

In our latest blog post, Dr Wojtek Paczos and Dr Kirill Shakhnov argue that an output drop alone increases the risk of foreign default, while a sudden expenditure hike alone increases the risk of domestic default. Thus, given the double nature of the COVID shock, recent proposals that would ease the burden of foreign debt after COVID-19 in emerging economies are necessary but may not be sufficient to prevent a wave of defaults on domestic debt.

The IMF has projected that the world output will contract by 4.9% in 2020 (IMF 2020). At the same time, governments have been forced to provide economic rescue packages at an unprecedented scale to mitigate the economic costs of COVID-19 pandemic. The combination of losses in output, fall in tax revenues, and increased fiscal expenditures will exert enormous pressure on public finances, especially in indebted developing economies. This was highlighted by Stiglitz and Rashid (2020): “With much economic activity suspended and fiscal revenues in free fall, many countries will be forced to default. Others will cobble together scarce resources to pay creditors, cutting back on much-needed health and social expenditures.”

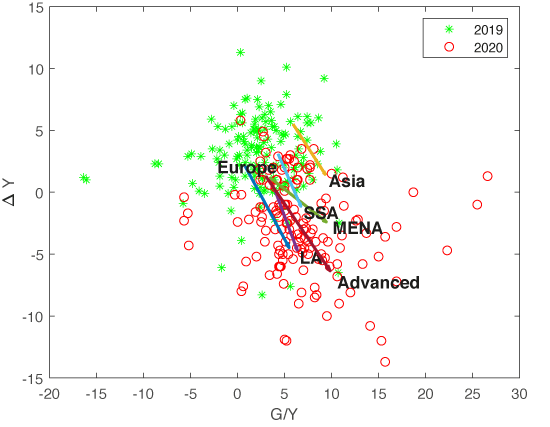

Figure 1 provides the expected scale of the real GDP growth and the primary deficit changes from 2019 (green stars) to 2020 (red circles). Relative to 2019, GDP growth of emerging markets in 2020 is expected to be lower by 5.7 percentage points, while their primary deficit is expected to increase by 4.3% of GDP. The new fiscal measures, which include additional spending and forgone revenue in the form of loans, equity, and guarantees, account for 5.1% of GDP in emerging economies (IMF 2020). The overall trend is evident, with the arrows representing average changes for country groups all pointing towards the southeast.

Figure 1

How should such unprecedented deficits and stimulate economies be financed? Governments have so far stockpiled debt in order to finance rescue and recovery packages. Elevated debt levels coupled with falling output and rising government expenditure bring back the question of debt sustainability. Due to a commitment problem, emerging economies will find it hard to issue further debt to smoothen the impact of economic disturbances. Consequently, economists and policymakers have called for urgent measures to be taken. The G20 countries have suspended interest rate payments on bilateral debts. In recent work, Bolton et al. (2020a, 2020b) argue for a broad “debt standstill” that will include private creditors and be available to a large set of countries, with debt to the extent of $3 trillion under consideration. There is also an increased academic interest in the economic effects of COVID-19 on emerging economies, with the recent research summarised in the new VoxEU eBook (Djankov and Panizza 2020).

The discussion in the recent literature focuses on external debt. Yet, external debt only accounts for a third of the total public debt of emerging economies; the remaining debt is owed to domestic investors. Defaults on domestic debt are not uncommon and are associated with economic disruptions comparable to those after foreign default – a fact considered “forgotten history” in macroeconomics (Reinhart and Rogoff 2011).

Domestic and foreign debts are hardly similar. Foreign debt involves transferring resources into and out of an economy, which can help to achieve consumption smoothing over the business cycle. Domestic debt cannot achieve this, as its issuance and repayment occur within an economy – domestic borrowing does not bring in additional resources.

In a new paper (Paczos and Shakhnov 2020), we propose a theoretical framework to analyse debt sustainability when a government has both domestic and foreign outstanding obligations. In this framework, a government observes productivity and deficit levels and sets the level of labour taxes to raise revenues for debt repayment. The government lacks commitment, so it can decide to default on either its foreign or domestic obligations (or both). Since the economic disruption from COVID-19 pandemic was sudden and unexpected, we plausibly model productivity and deficit changes as exogenous developments.

In our model, repayment is costly: a government has to increases taxes, which imposes endogenous distortion on the economy. However, in the case of domestic debt, this distortion is partially mitigated by resources flowing back to domestic households. Default is also costly: based on empirical evidence (e.g. Reinhart and Rogoff 2011) we assume that after a default, an economy’s level of productivity is reduced.

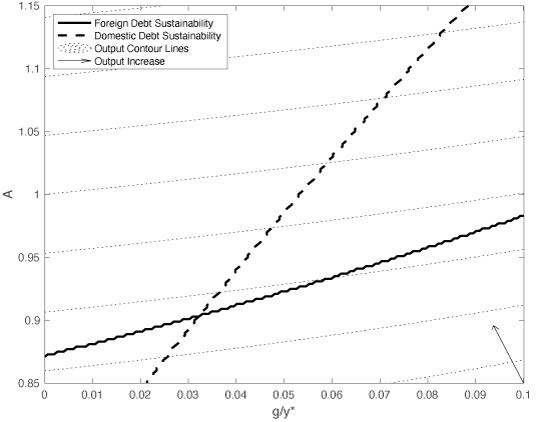

We find a striking result: an almost perfect separation of domestic and foreign default decisions. Foreign default is more likely after a negative productivity shock and is almost independent of the level of public expenditure, while domestic default is more likely after a large public expenditure shock but is almost independent of the level of productivity. Figure 2 illustrates this result.

Figure 2

The graph is a theory equivalent of the empirical Figure 1. The vertical axis represents productivity level (A) and the horizontal axis represents government spending (g) scaled by output (y∗). The dotted lines represent output contours. Foreign debt repayment line (solid) is almost parallel to the output contours, while the domestic debt repayment line (dashed) steeply crosses output contours. A debt is repaid when the economy is above the repayment line. A sudden and large drop in A causes the government to declare a default on its foreign debt. A sudden and large increase in g on the other hand causes the government to declare a default on its domestic debt. Both shocks reduce economy’s output. After a ‘COVID shock’, when A falls and g increases, the economy risks a total default – moving to the bottom-right part of the graph.

The exact positions of the repayment lines on the graph are governed by the parameters of the model, but their different slopes are driven by the economic mechanism and are robust to parameter changes. Households treat foreign and domestic default differently. When a government defaults on foreign debt, the economy suffers from a decline in productivity but households benefit through lower taxes. This trade-off is independent of the level of government expenditure. Hence, foreign default is primarily driven by productivity shock. When a government defaults on domestic debt, households pay lower taxes but they also lose their savings. As a result, they work more and become less responsive to tax changes. The latter effect is independent of the level of productivity. Hence, domestic default is primarily driven by expenditure shock.

We conclude that a ‘COVID shock’, which reduces output and increases government expenditure, brings the economy closer to a total default. Even in the case of well-designed foreign debt restructuring and ‘standstill’ programmes, we can still expect a wave of domestic defaults.

References

- Bolton, P, L C Buchheit, P-O Gourinchas, G M Gulati, C-T Hsieh, U Panizza and B W di Mauro (2020a), “Necessity is the mother of invention: How to implement a comprehensive debt standstill for COVID-19 in low- and middle-income countries”, VoxEU.org, 21 April.

- Bolton, P, L C Buchheit, P-O Gourinchas, G M Gulati, C-T Hsieh, U Panizza and B W di Mauro (2020b), “Sovereign debt standstills: An update”, VoxEU.org, 28 May.

- Djankow, S and U Panizza, “COVID-19 in developing economies: A new eBook”, VoxEU.org, 22 June.

- IMF (2020), World Economic Outlook Update, June 2020.

- Paczos, W and K Shakhnov (2020), “Defaulting on COVID Debt: Foreign or Domestic”, COVID Economics 45, 28 August.

- Reinhart, C M and K S Rogoff (2011), “The Forgotten History of Domestic Debt,” Economic Journal.

- Stiglitz, J and H Rashid (2020), “How to prevent the looming sovereign debt crisis”, VoxEU.org, 03 August.

Dr Wojtek Paczos is a macroeconomist and lecturer at Cardiff Business School and at the Institute of Economic Sciences of the Polish Academy of Sciences.

Dr Kirill Shakhnov is a Lecturer in Economics at the University of Surrey.

This article was originally published on Vox Eu.

- March 2024

- April 2023

- August 2022

- July 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018