Not so fast – for Welsh local authorities, austerity won’t be “coming to an end” any time soon

18 February 2019This post draws on work from a recently published report into local government finance by Guto Ifan and Cian Sion from the Wales Fiscal Analysis team: Cut to the bone? An analysis of Local Government finances in Wales, 2009-10 to 2017-18 and the outlook to 2023-24.

At last year’s Autumn Budget, the UK Chancellor, Philip Hammond, asserted with confidence that “austerity is finally coming to an end”. His claim is unlikely to resonate within the halls of local government in Wales. Despite nearly a decade of sustained budget cuts, the outlook for local government finance suggests that tough choices and trade-offs are here to stay.

In Part 2 of this two-part series examining local government finance in Wales, we explore the outlook for local authorities’ budgets and offer revenue projections for the next five year period.

The outlook for local government revenue up to 2023-24

The final local government settlement for 2019-20 released in December 2018 offered a cash flat settlement to local authorities, and top-up funding and extra allocations means no local authority will see a reduction to their funding of more than 0.3% in nominal terms next year. Despite being a much brighter picture than under previous plans, all local authorities face a real terms reduction of between 0.9% and 2.1% in their level of funding between 2018-19 and 2019-20.

In the face of rising cost and demand pressures, councils across Wales are likely to propose significant increases to Council Tax levels as they set their budgets for next year. As we look at the outlook beyond 2019-20, steep Council Tax rises may well become a permanent fixture of the fiscal calendar.

According to OBR forecasts, UK government day-to-day spending will increase in real terms by around 1.2% each year until 2023-24. Given that we know the planned increase for the NHS in England and other UK government commitments relating to defence and international aid, we can project the likely implications for the Welsh Government budget over coming years (Figure 1).

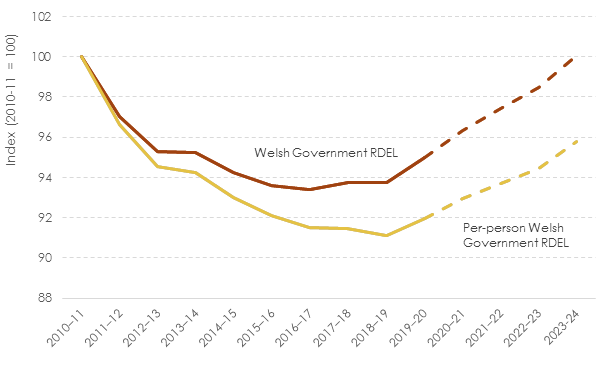

Figure 1: Welsh Government resource DEL (day-to-day spending), 2010-11 to 2023-24 (2018-19 prices, with adjustments)

Welsh Government day-to-day spending is now set to increase in real terms. Based on current projections, the Welsh Government budget will reach its 2010-11 level in real terms by 2023-24, although on a per-person basis, it is unlikely to reach this level until the end of the next decade.

Core NHS spending has increased as a share of the Welsh budget to around 48%. This means that decisions around future growth in NHS spending will inevitably have a significant bearing on the funding available for other areas of spending, including local government settlements.

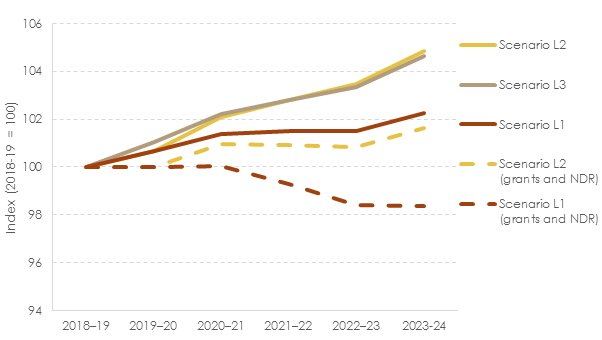

To illustrate how different policy decisions could affect local authorities’ revenue, we have modelled three scenarios, shown in Figure 2.

Scenario 1 (L1) supposes that the Welsh Government increases core NHS spending by 3.3% each year in real terms, broadly matching the planned increase in NHS funding in England. With NHS spending increasing faster than the overall budget, this would result in support for local government falling in real terms (dotted red line). The increase in overall local government revenue (solid red line) would come from local authorities increasing Council Tax levels in line with OBR forecasts at around 4.4% a year.

In the second scenario (L2) we model, the Welsh Government increases core NHS spending by a more modest 2.1% each year in real terms (roughly matching real terms growth since 2013-14). This would result allow for faster growth in other areas of spending. Grants and redistributed NDR revenues to local authorities would increase by 1.6% in real terms by 2023-24 (dotted yellow line). Assuming the same rise in Council Tax levels, budgets would increase by 4.9% in real terms (solid yellow line).

A similar growth in budgets could be achieved even if support from the Welsh Government continues to fall as in the first scenario, if Council Tax levels were to grow faster than the OBR forecasts. Scenario 3 (L3) models annual increases of 6.4% a year in nominal terms, which would increase local authorities’ budgets by 4.6% in real terms by 2023-24 (solid grey line). Under this scenario, Council Tax would account for just under a quarter of local government financing by 2023-24.

Figure 2: Local government revenue projections under scenarios L1-L3, 2018-19 to 2023-24

Choices and trade-offs between councils’ service areas

As we detailed in part 1, it has been the unprotected services outside of education and social services which have seen the largest cuts in spending since the start of austerity.

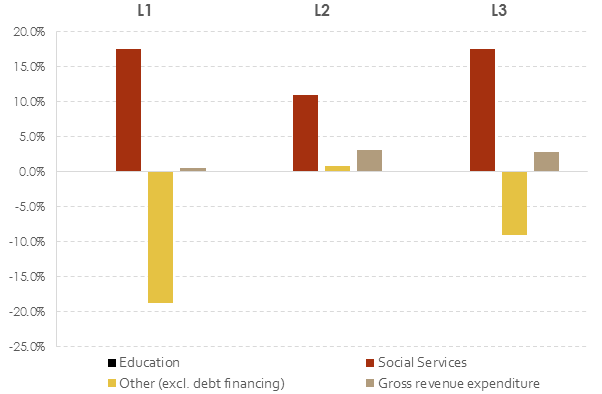

Supposing that councils decided to prioritise education and social services spending, as they have done in recent years, we can make some projections about what the impact would be on unprotected spending areas under each scenario. Figure 3 shows the projected change in spending if local governments decided to protect education spending in real terms and increase social services in line with the core NHS budget each year until 2023-24.

Figure 3: Changes to spending by local government area if education is protected, and social services budget is increased in line with WG core NHS spending, under scenarios L1-L3, 2019-20 – 2023-24 (2018-19 prices)

A 3.3% real terms annual increase in the social services budget would see it grow by 17.6% by 2023-24. Under the first modelled scenario, spending on unprotected areas would have to fall by -18.8%.

In contrast, if the Welsh Government planned a more modest 2.1% increase in the core NHS budget and social services spending matched this increase, spending on unprotected areas would not see further cuts.

If the Welsh Government does plan to match increases on NHS spending in England, then the faster Council Tax growth modelled in the third scenario would reduce the cuts to unprotected areas to -9.1% by 2023-24.

Conclusions

The Welsh Local Government Association (WLGA) have warned that authorities are “running out of road” to avoid cuts to education and social services. To avoid making further deep cuts to unprotected spending areas, local authorities will need to continue increasing Council Tax rapidly over coming years.

Given the current outlook for public finances in Wales, it would appear the only way to meet the increasing demands for health and social care, avoid further large cuts to unprotected services, and limit rapid (and regressive) Council Tax increases, would be for the Welsh Government to make use of its new fiscal powers to increase the size of its budget. For example, an increase in the Welsh Rates of Income Tax or a Social Care Levy could present a more progressive alternative to Council Tax increases.

None of these options will be politically easy. Fiscal devolution promised to spark a debate around how best to raise revenue to support devolved and local spending. The future financing of local government in Wales should be a crucial part of that debate.

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections