‘Now you see it, now you don’t’ — Is the university pension fund really in deficit?

21 August 2019

In our latest blog post, Dr Woon Wong argues that the discount rate currently used to value the liabilities of the Universities’ Superannuation Scheme is too low, and that the largest higher education strike in British history followed by the forming of the Joint Expert Panel help to reveal that the claim of a deficit is fallacious.

It has long been suspected that falling gilt yields overstate the liability of defined benefit (DB) schemes. It is thus surprising to find that, based on projected benefit payments data available from the University Superannuation Scheme (USS), ‘gilt-plus’ (gilt yields plus a fixed margin) discount rates actually reduce the reported 2017 deficit of the USS from £7.5bn to £3.4bn.

This finding makes the reason behind the 2017 deficit ever more puzzling since the valuation assumed that gilt yields would revert back to their higher (2014) level in ten years’ time (thereby implying a deficit lower even than that obtained by a gilt-plus method). Regulatory guidelines require assumptions be evidence-based.

“If evidence-based discount rates are used, the scheme is found to be in a surplus that can be as large as £7.5bn.”

Debating the discount rate

The problem with the USS’s valuations is related to the discount rate debate that was published by the Pensions Regulator (tPR) in the 2017 Annual Funding Statement for Defined Benefit Schemes.

In that debate, proponents of gilt-plus valuations argued that low gilt yields mean low returns on other asset classes. Recent research, however, shows that gilt yields are driven by inflation whereas returns on equities (the most important asset class for pension funds) are determined by firms’ productivity in the real economy.

“The fall in gilt yields since the 1970s are the result of successful monetary policy to target inflation in order to ensure optimal economic growth, which in turn makes businesses profitable and hence healthy returns on equities.”

Furthermore, Lord Paul Myners CBE (the UK’s financial services secretary during the 2008 financial crisis) questions the wisdom of discounting pension liabilities at the current low-interest rates, which have been manipulated through quantitative easing. Such a view is shared by economists who regard long term interest rates as inappropriate discount rates after they have been used as monetary policy tools.

Also, gilt yields may have been depressed relative to economic fundamentals by the Pensions Act 2004, since this requires pension managers to purchase gilts regardless of price. An investment bank estimates the potential demand for index-linked gilts as five times the size of the current market.

The need for transparency

The USS has refused repeated requests by scheme members for information such as the projected benefit payments data. It is only after a member of the Joint Negotiation Committee (representing University and College Union) obtained the required information from USS that the findings reported in this article are made possible.

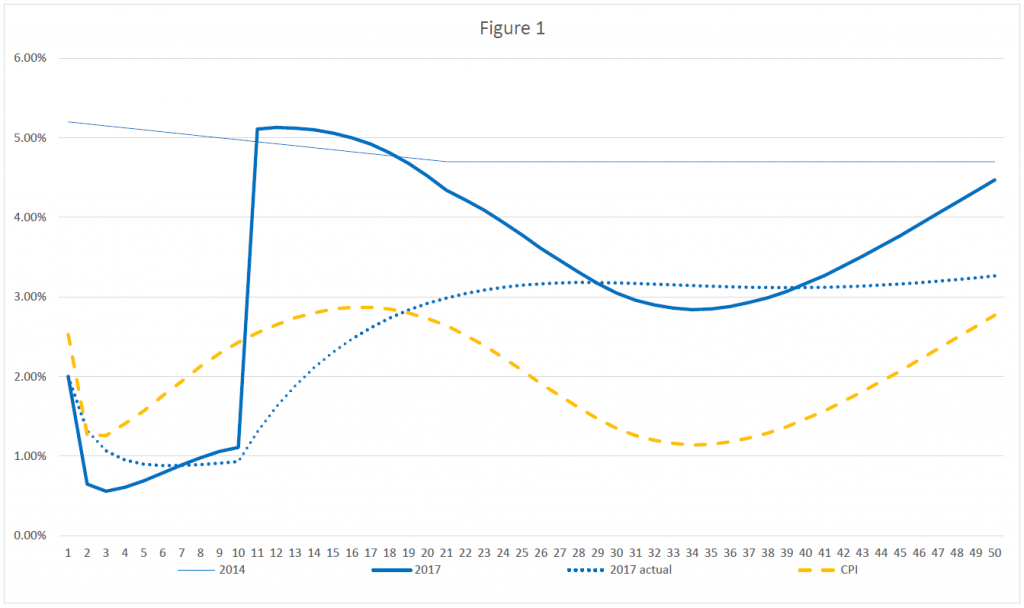

It turns out that the reported discount rates are actually investment returns, not discount rates in the usual sense. Since the 2017 reported discount rates (investment returns) begin and remain at a very low level for ten years, the resulting actual discount rates are significantly lower; as shown in Figure 1.

The above revelation raises the issue of frankness in the governance of USS. Letters have been written in the past pointing out to USS that the scheme’s deficits are the outcome of falling gilt yields rather than any true funding shortfall.

“While the USS denies the use of gilt-plus methods in the 2017 valuation, it fails to mention that the new approach actually produces a deficit that is higher than that obtained by gilt-plus discount rates.”

As Figure 1 illustrates, the 2017 reported discount rates being deceptively close to those of 2014 does not help convince its scheme members that USS is acting openly (in spite of the fiduciary duty of trustees to act honestly).

Evidence-free assumptions

The USS attributes the initial low investment returns to high asset prices buoyed by low-interest rates and a possible market down rating. However, the first ten years of investment returns average only 0.93 per cent, which is significantly lower than the gilt yield of 1.727 per cent as at the valuation date. A simulation study can show that the low return assumption is equivalent to using a rate with a less than 10 per cent probability to value a DB scheme.

Also, the 2017 discount rates and inflation forecasts have varied like a rollercoaster for 50 years. It turns out that the discount rates are required to fall from year 11 to less than 2.8 per cent at year 34 in order to ensure the failure of Test 1 in the 2017 valuation.

“Needless to say, the rollercoaster variation of discount rates and inflation forecasts is inconsistent with the inflation targeting policy of the Bank of England.”

Finally, both gilt yields and US interest rates were at similar levels at the time of 2014 valuation. Since Brexit, the spread of US interest rates over gilt yields has widened to around 1.3 per cent, which further confirms the assertion that gilt-plus valuation inflates pension costs.

This is because (a) the assets of USS are internationally diversified, and hence (b) if the level of interest rates were to determine returns on other asset classes, it would be the US interest rate that calls the shots.

Role of academics

Earlier research has shown that managers have been known opportunistically to use downward-biased discount rates to inflate pension costs in order to obtain labour concessions.

What happened to USS is worse: opaque valuation method based on un-evidenced assumptions provided the 2017 deficit which led to a decision to close the USS DB scheme? — an outcome that only the largest strike in British higher education history has been able to prevent.

Note that as a result of continuing closure of DB schemes in the UK, the pension industry is anticipating an estimated additional £1 trillion annuities business in the next 20 years.

The economic truth is that DB schemes enjoy intergenerational risk-sharing and time-diversification of risk that no other pension designs can match. Moreover, regulations require trustees to always act in the best interests of scheme beneficiaries, which means implementing the regulatory guidelines of evidenced-based assumptions for valuation.

While the report of Joint Experts Panel (JEP) has vindicated the industrial action, the recommendations of JEP remain merely advisory. Therefore, it is vital for economists (and other academics) to scrutinize the assumptions that underpin the valuations of USS.

Dr Woon Wong is a Reader in Financial Economics at Cardiff Business School.

This article originally appeared in the Royal Economic Society Newsletter (April 2019).

- March 2024

- April 2023

- August 2022

- July 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018