When the going gets tough – analysing the Welsh Government Outline Draft Budget

4 October 2018

As he delivered the Outline Draft Budget for 2019-20, the Cabinet Secretary for Finance Mark Drakeford described this budget round as the “toughest yet”.

This was the eighth Welsh Government budget since the start of UK austerity measures, which has left the overall Welsh budget 5% lower in real terms since 2010-11. It is also a budget set in a time of looming uncertainty, with a resource budget set for one year only before the UK Government Spending Review next year, not to mention the potential impact of Brexit on the UK economy and public finances.

It is a budget set in the context of increasing cost and demand pressures on public services, and a warning that Welsh councils were ‘running out of road’ to avoid cuts to their two largest areas of education and social services.

A more detailed Draft Budget will be published on October 23. Less than a week later, the Chancellor of the Exchequer will deliver his autumn budget, which could have implications for Welsh Government’s spending plans.

Overall picture

The overall picture is somewhat brighter than the indicative spending plans for 2019-20 laid out in the 2018-19 Final Budget last December.

The main change since then has been the NHS “birthday gift” funding announcement by the UK government in July, which has triggered £365 million in consequential spending for the Welsh Government for 2019-20. This increase was a part of a five-year funding package for the English NHS worth over £20 billion in real terms.

Any increases added to the Welsh block grant through the Barnett formula are now 5% greater than was previously the case, thanks to the needs-based factor agreed as part of the fiscal framework agreement in December 2016.[1] This ‘Barnett bonus’ has provided an additional £70m so far for Welsh budgets, and will be worth around £271 million over the five years covered by the NHS announcement.

The Welsh Government will also boost its resource spending by drawing down £125 million from the Wales Reserve (created to provide extra flexibility for the Welsh Government last April), up from the planned £75 million.

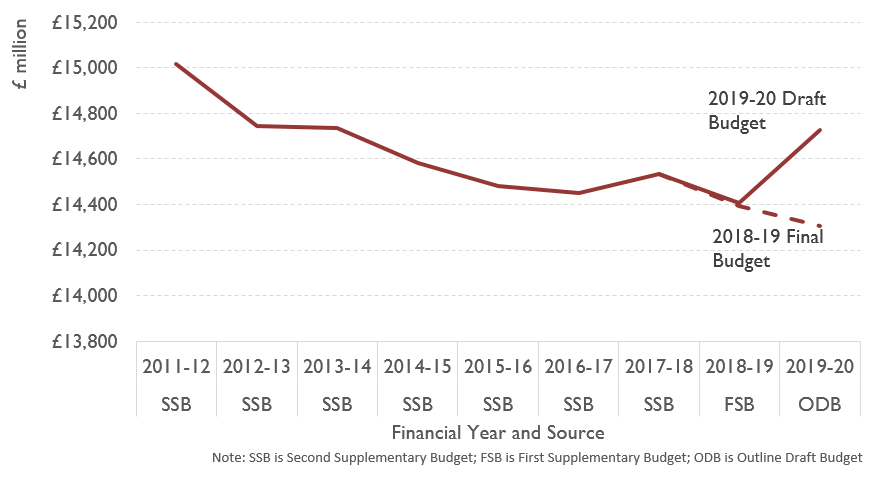

These decisions mean the day-to-day spending limits set for Welsh Government departments in 2019-20 (the fiscal resource DEL) will increase by around 2.2% in real terms from 2018-19, rather than falling as was projected last December. As can be seen in figure 1, this uptick in spending only partially reverses past cuts.

Figure 1: Trend in fiscal resource DEL (including Non-Domestic Rates), 2011-12 to 2019-20 (2018-19 prices)

The capital budget allocated to departments (including financial transactions[2]) will also increase by 3.2% in real terms to 2019-20.

The Welsh Government will borrow £125 million for capital spending (below the £150 million annual limit agreed as part of the fiscal framework agreement). The budget document states that the Welsh Government will seek to increase its annual and aggregate borrowing limits set by the Treasury before the 2019 Spending Review. This provides a relatively cheap source of capital financing for the Welsh Government from the National Loans Fund, based on an assumption of an average interest rate of 2.22% over 30 years.

In addition to its capital budget and borrowing powers, the Welsh Government has also sought to make use of ‘innovative finance schemes’. Two local government borrowing initiatives, the Housing Finance Grants to support local authorities to deliver housing proposals, and a new Coastal Risk Management Programme have a combined estimated capital value of £870 million. The revenue implications of these schemes for the Welsh Government budget for 2019-20 stands at £37.4 million.

Departmental allocations

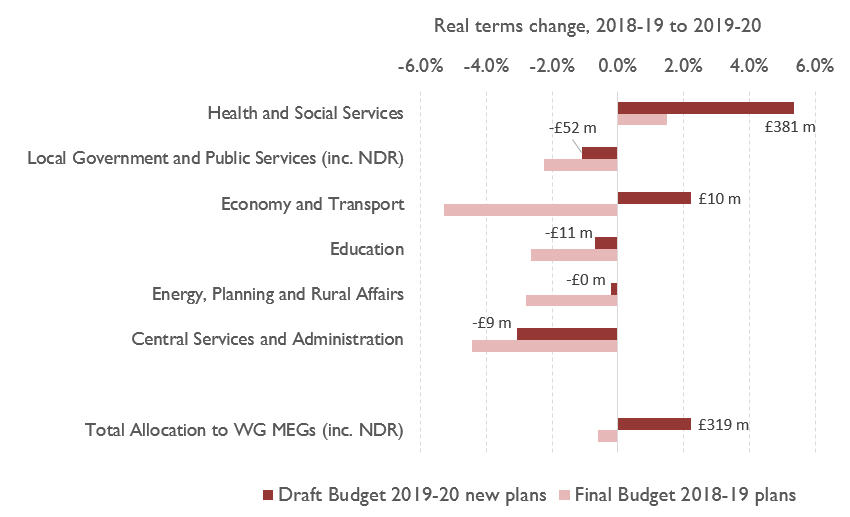

Although the high-level tables for allocations to departments published this week allow for only limited analysis, they do give an indication of how the Welsh Government has decided to spend the extra resource available to it. Figure 2 shows the real year-on-year change to 2019-20 of each Main Expenditure Group (MEG) under the previous indicative (2018-19 Final Budget) plans and the new plans set out in this Draft Budget.

While the extra funding has been distributed across all areas, the Health and Social Services MEG has seen the largest increase: including already planned increases, it will increase by 5.3% in real terms from 2018-19 to 2019-20. In evidence to the Finance Committee, the Cabinet Secretary emphasised this extra funding was for the whole system of health and social care rather than just for core NHS delivery (which accounts for around 93% of the MEG). £30 million of the increase to this MEG will be distributed to local authorities to address pressures in social care, while another £30 million will go towards regional partnerships between health boards and local authorities.

Figure 2: % change in total fiscal resource DEL allocations to departments (MEGs) from 2018-19 to 2019-20

The Local Government and Public Services MEG mainly consists of the Local Government General Revenue Funding grant. Alongside redistributed non-domestic rates revenue, this funding was set to fall by around 2.3% in real terms under previous plans. Extra allocated resources means it will grow slightly in cash terms, but will still fall in real terms. The local government settlement will provide a clearer picture of how funding is changing, but councils are expecting significant cuts.

The lifting of the 1% pay cap for public sector workers means that local authorities, alongside other Welsh public services, are facing additional costs this year. Public sector pay deals are a more significant moving part in this budget compared with previous years, with an extra £13.7 million announced for teachers’ pay and £95 million to fund the Agenda for Change pay deal for NHS staff in 2019-20.

Taxes

Another important change for this year’s budget was the introduction of the Welsh Rates of Income Tax. The devolution of £2.1 billion of income taxes means own-sourced revenues now account for a fifth of the Welsh budget.

For 2019-20, the block grant adjustment (BGA) made to the Welsh budget will equal the revenues raised in Wales, leaving the size of the budget unchanged. In future years, this BGA will change according to growth in comparable revenues in England and Northern Ireland. This means that the relative growth of the Welsh tax base will become an important future determinant of the resources available for Welsh public services, something acknowledged in the Chief Economist’s Report accompanying the budget.

For the other (smaller) devolved taxes, there was a big upward revision in the forecast for Landfill Disposals Tax based on stronger-than-expected first quarter revenue collection. The forecast for Land Transaction Tax revenues in 2019-20 on the other hand has fallen to £258 million, down from £269 million forecast last December. However, since this revision reflects trends across the UK, the BGA mechanism will protect the Welsh Government budget from this fall. In fact, the total block grant adjustment for the two devolved taxes is £271 million in 2019-20, compared with £298 million of forecast revenue, resulting in a £27 million boost to the Welsh budget.[3]

Meanwhile, there were no major changes in devolved tax policy. The Cabinet Secretary kept Land Transaction Tax rates constant, though like last year he will be reviewing any changes made by the UK Chancellor to Stamp Duty rates in England and Northern Ireland at the budget later this month.

He also reaffirmed the pledge not to raise income taxes, in line with the Welsh Labour manifesto commitment. This was the first time the size of the Welsh Government budget could have been materially changed by a devolved tax policy decision; a 1p increase at all bands could have increased the fiscal resource DEL by a further 1.4%.

While doing this will have been a temptation, an increase at the basic rate would have resulted in a tax increase for lower earners, as emphasised by the Cabinet Secretary in his evidence to the Finance Committee. As the Welsh Government does not have powers over thresholds, the option of protecting or cutting tax only for low earners is not available as it was for the Scottish Government last year.

Conclusion

As highlighted by the Chief Economist’s Report, the medium-term prospects for the Welsh budget will depend on how the UK government decides to fund the recently-announced increases in spending on the NHS in England. While the 2019-20 budget assumes the announced NHS increase feeds through to the Welsh budget, some of it could be funded through cuts in other departments, reducing the net consequentials added to the Welsh budget. The UK government budget on October 29 could force a change in Welsh Government spending plans before its Final Budget in December.

The Welsh Government will be sceptical of Theresa May’s announcing an end to austerity at her conference speech this week. A UK Government Spending Review set in the context of a ‘no-deal’ Brexit could see tougher budget rounds to come.

[1] For further information on the changes to Block Grant Funding arrangements see: http://sites.cardiff.ac.uk/wgc/files/2016/11/Fair-Funding-for-Taxing-Times-Assessing-the-Fiscal-Framework-Agreement.pdf

[2] These can only be used for loans and equity investments to third parties, and usually have to be repaid to HM Treasury.

[3] Updated OBR forecasts later this month will likely affect the block grant adjustments, as well as the elements of the Welsh Government’s forecasts based on UK-wide determinants.

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections