Taxing Times: WRIT and the Welsh Government’s Draft Budget 2023-24

8 February 2023

Yesterday, the Welsh Government’s Draft Budget for 2023–24 was debated on the floor of the Senedd. The debate centred around prepared statements by Welsh Government Finance Minister Rebecca Evans (Labour) and the Chair of the Finance Committee, Peredur Owen Griffiths (Plaid Cymru). Amendments were tabled by Peter Fox, Shadow Minister for Finance (Conservative) and Plaid Cymru’s leader Adam Price.

In the run up to the Draft Budget’s publication in December, we predicted that the demanding budget outlook would revive the debate around the use of devolved income tax powers. Indeed, in the aftermath of the UK government’s mini budget, the First Minister Mark Drakeford remarked that he was “powerfully considering” increasing tax rates.

Although the Welsh Government ultimately opted to leave income tax rates unchanged, Welsh Rates of Income Tax (WRIT) still featured prominently in yesterday’s discussion in the Siambr. With another income tax-related debate tabled for today, it’s a good time to take stock of what the current powers over WRIT look like, what raising tax rates might mean for households, and the scope for further devolution.

Easy as 1-2-3?

To illustrate what might be possible using the existing tax powers, let’s consider the amendment proposed during yesterday’s Budget debate. The amendment – which was roundly defeated at voting time – called on the Welsh Government to raise Welsh rates of income tax (WRIT) for the upcoming financial year. The proposal would have seen WRITs increased by 1p on the basic rate, 2p on the higher rate, and 3p on the additional rate. Let’s call it the ‘1-2-3’ proposal.

Income tax is paid on earned income above the personal allowance threshold of £12,570. Income between the personal allowance threshold and £50,270 is taxed at 20%. Earnings above £50,271 and £125,140 (from 2023−24) are taxed at 40% and 45% respectively.

Under current arrangements, 10p in every £1 earned by basic rate payers is paid to the Welsh Government and 10p is paid to the UK government. For higher and additional rate payers, 10p in every £1 is paid to the Welsh Government and 30p / 35p is retained by the UK government. The increase proposed by Plaid Cymru would apply to the Welsh portion of these rates.

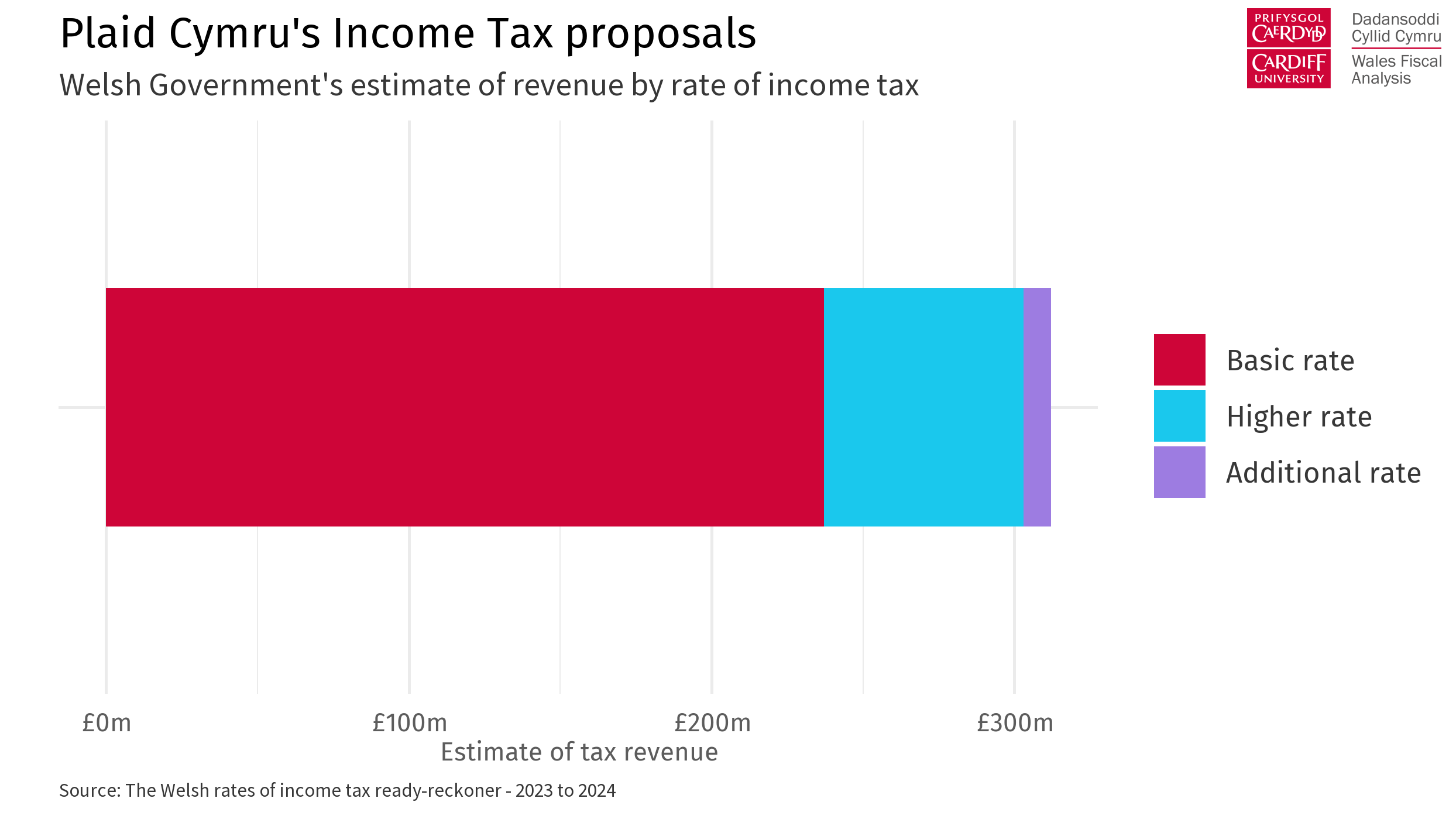

How much could be raised under this ‘1-2-3’ proposal? Using the Welsh Government’s ‘ready-reckoner’ for next year, we estimate that this could raise an additional £312 million. The plot below breaks this down by tax rate, with £237 million pounds coming from the basic rate, £66 million from the higher rate, and £9 million from the additional rate. These estimates include an allowance for potential behavioural and migration responses – though their exact size remains uncertain.

Relative to the size of the budget, the additional revenue from the proposals would increase day-to-day spending on public services by 1.6% in 2023-24.

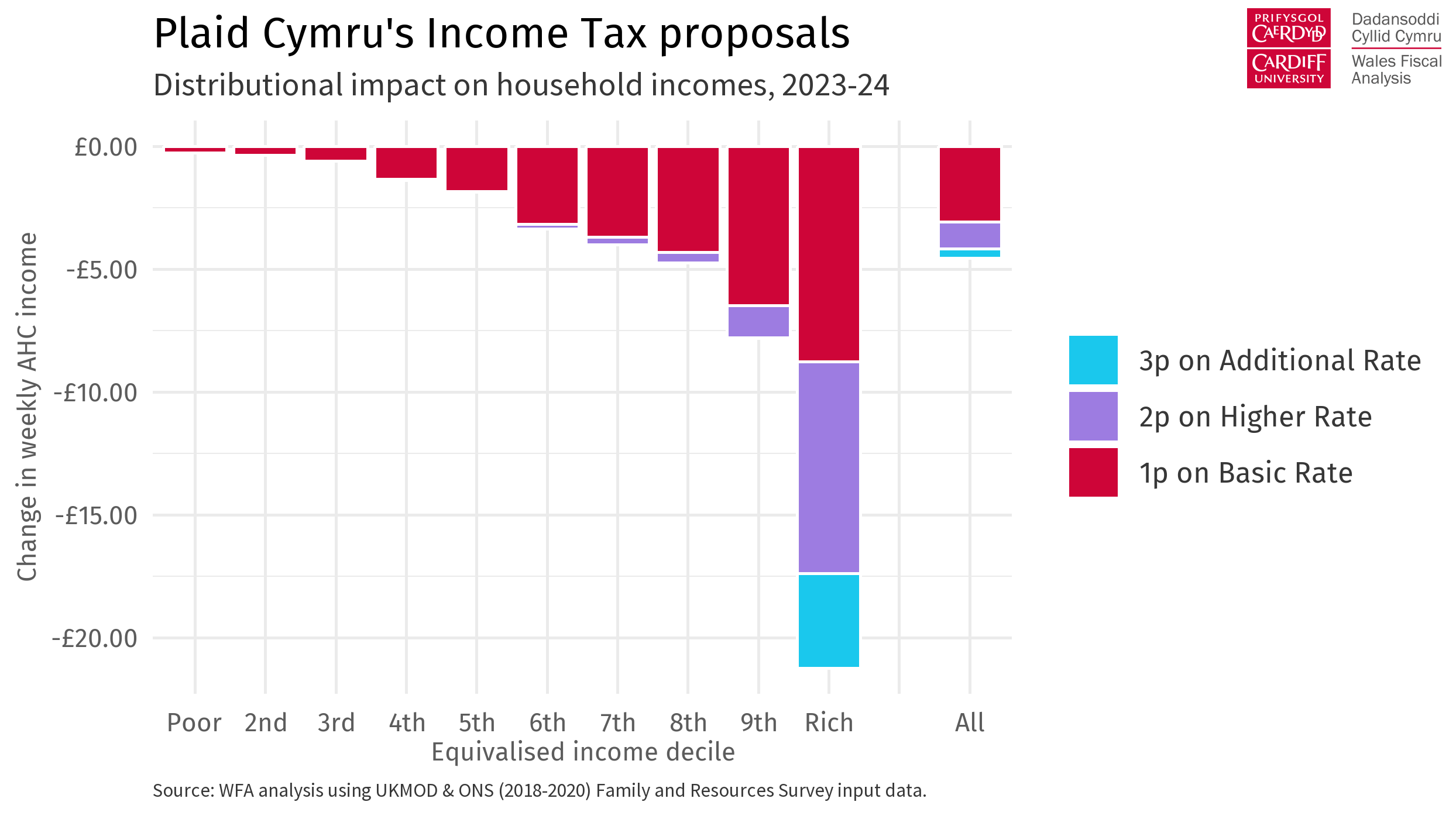

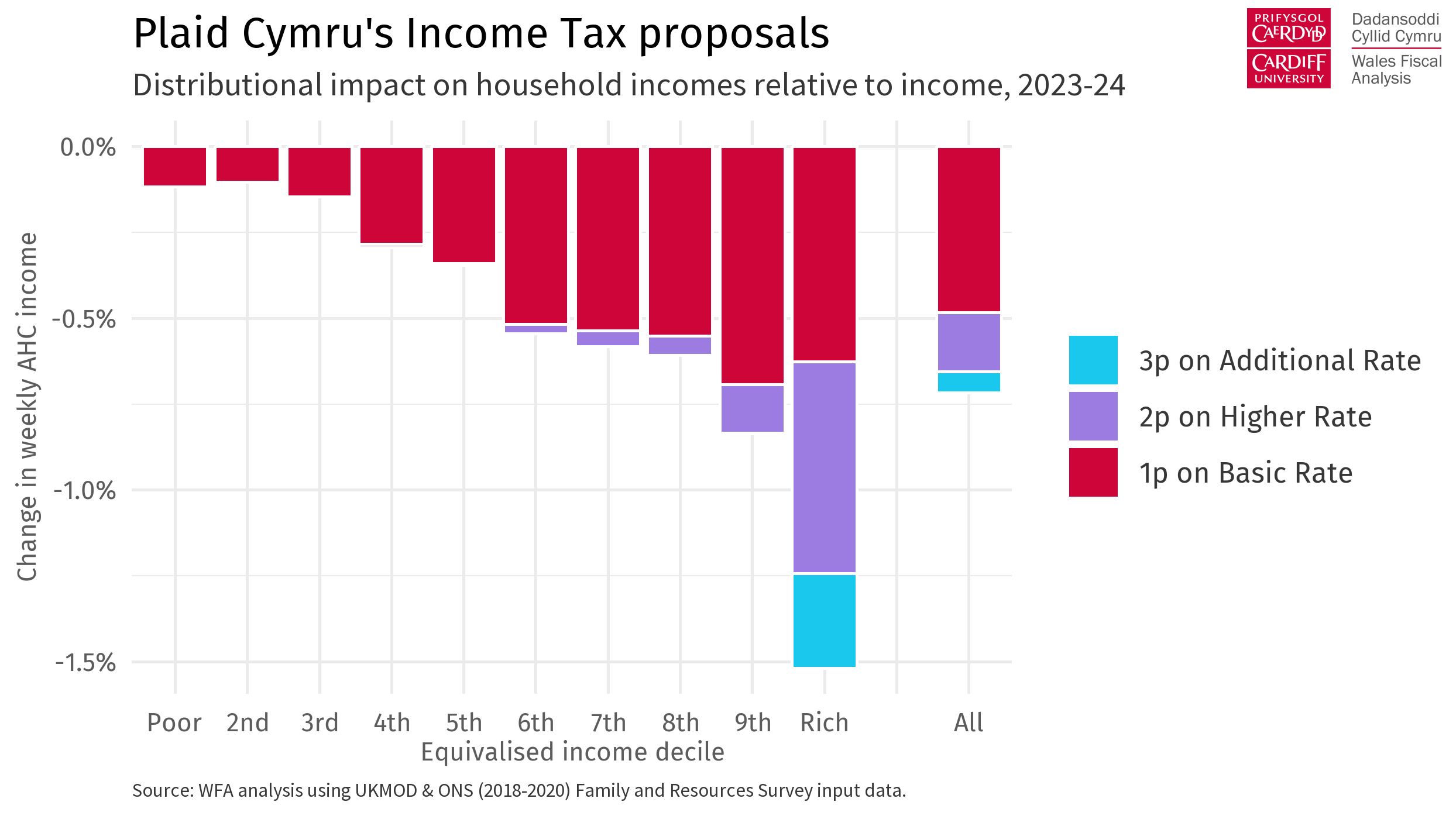

We have also estimated the financial impact of this proposal on household incomes. The plots below show the absolute and percentage change in household income after housing costs, by income decile. Although most of the additional revenue would be raised via the basic rate, the effects on household income are still highly progressive. The typical household would pay an additional £5 a week, with the highest earners contributing more.

As a share of income, this additional tax bill would amount to less than 1% of income for households in the poorest 9 deciles, and less than 0.25% of income for households in the lowest income quartile. That most poorer households are shielded from changes to WRIT is partly by design. The personal allowance – which the UK government has now frozen at £12,570 until April 2028 – means that many low earners are relieved from paying any income tax.

There is of course a separate question about how the Welsh Government might have used any additional funding raised from increasing WRIT. While additional tax revenue could potentially have been used to fund improved pay awards this year, this would not be a sustainable way to top-up pay awards year-after-year – a point made by the Finance Minister. And even under the relatively ambitious ‘1-2-3’ proposal, the amount of additional revenue raised would have been relatively small. To put the amount in perspective, each percentage point increase in pay for public sector workers increases the devolved pay bill by roughly £100 million.

Further tax devolution?

In a report published earlier this week, the Senedd’s Finance Committee recommended that the Welsh Government undertakes foundational work into the risks and benefits associated with devolving powers to modify Welsh rates of income tax bands and thresholds – powers over which are currently reserved to the UK government.

In Scotland, where income tax is (almost) wholly devolved, the Scottish Government has made quite extensive use of its powers over tax bands and thresholds, alongside increasing tax rates overall.

With similar powers, the Welsh Government could potentially create different tax rates for those on lower incomes, shielding them if they wished to raise additional revenues for the budget.

With greater responsibility would come additional risks – any divergence in the Welsh tax base would have a more significant impact on the Welsh budget. But the positive experience of tax devolution thus far may whet the appetite for the risk and reward of further tax devolution.

It is notable that amidst the toughest budgets since devolution, the current powers over income tax have not been used. In the context of the demanding budget outlook, debates over the use and extent of Welsh tax powers are here to stay.

Featured image from Wikimedia Commons, used under the CC BY 2.0 license.

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections