The public sector pay bill in Wales

24 June 2019

The public sector in Wales

When economists and politicians talk about the public sector, they are referring to the part of the economy that is owned, funded or run by central or local government. This includes all levels of government administration, publicly-funded health and social care, social security, education, defence and policing.

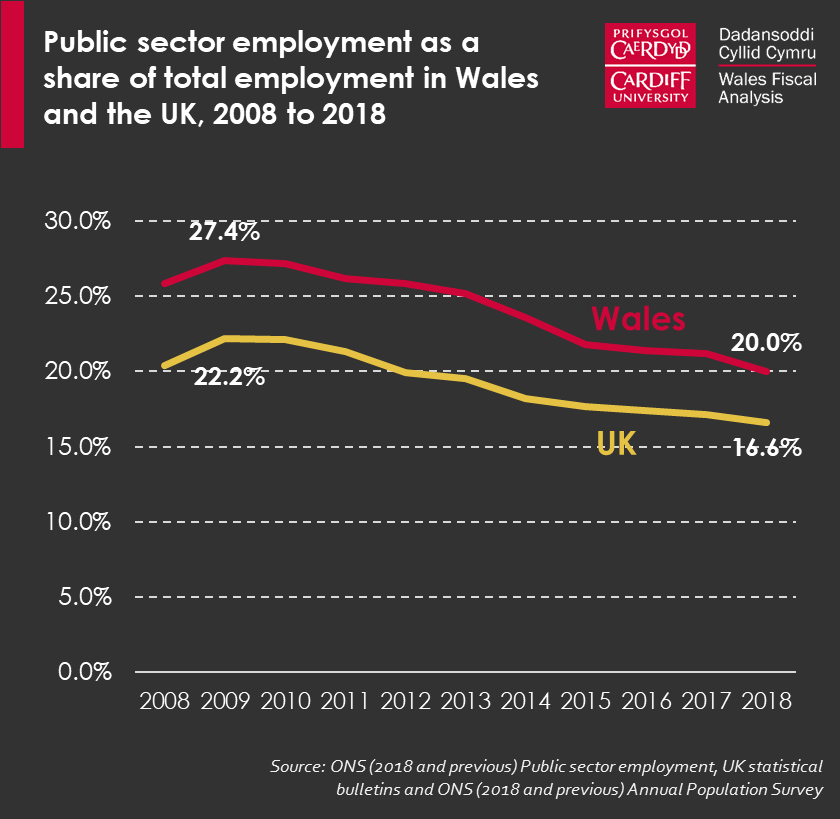

Wales has historically had a relatively large share of its workforce in public sector employment. As traditional industries declined, the NHS and local government became increasingly important employers. This was accompanied by the relocation of several large UK government agencies to Wales, including the DVLA to Swansea, ONS to Newport and Companies House to Cardiff — one of the reasons why Wales has a higher ratio of civil servants per member of population than London at 105 in every 10,000.

Although the share of the Welsh workforce employed in the public sector has been consistently higher than the UK level for several decades, both figures currently stand at an historic low – 20.0% in Wales and 16.6% for the UK as a whole.

Estimating the pay bill

We estimate that in 2017-18, the Welsh Government and local authorities’ public sector pay bill (i.e. excluding reserved functions) amounted to £7.83 billion.

Click on individual blocks to reveal more details on areas of the pay bill. Hover / tap-and-hold to reveal employee costs for each function.

By far the two largest components of employee costs in 2017-18 were the NHS at £3.63 billion (46.3%) and local authorities at £3.55 billion (45.4%).

Teachers and other school staff are included on local authorities’ pay roll. Collectively they account for 58.5% of local authorities’ employee costs or 26.5% of the total public sector wage bill. Education-related employee costs have fallen by £69.4 million (3.2%) in real-terms since 2009-10 whereas other local authority employee costs have fallen by £134.9 million (8.2%).

Historically, local authorities have accounted for the largest share of the public sector pay bill in Wales. In 2009-10, local authorities’ employee costs were £430 million higher than in the NHS. However, cuts in central government support to local authorities and real-terms increases to the NHS budget since 2013-14 meant that in 2016-17, the NHS overtook local government as the largest component of the pay bill.

Despite this, local government remains the largest public sector employer in Wales, employing 152,000 workers as of September 2017.

In addition to NHS Wales and local authorities, the public sector pay bill includes the employee costs of Welsh Government staff and large subsidiaries (£337.9 million), Welsh Government sponsored public bodies (£140.3 million), three fire and rescue services (£116.5 million), various scrutiny bodies and Commissioners (£71.3 million) and three national parks (£12.3 million).

Outlook for the future

Looking into the future, pension contributions are set to continue being a source of pressure on the public sector pay bill. Following a decision by the UK government, employer contributions to the public service pension schemes have increased from 2019. The Welsh Government recently announced a package of additional funding for local authorities to meet pension contribution costs for teachers, firefighters and other public sector employees in 2019-20. However, in the medium to long-term, these pressures are unlikely to go away.

An increasing Welsh budget over coming years will broadly enable the Welsh Government to meet the increased costs associated with the end of public sector pay cap. The UK government’s indicative spending plans suggests that day-to-day resource spending will increase by around 3.3% a year (in nominal terms) to 2023-24.

However, the employee cost pressures are likely to be more acute for some public services (outside of NHS spending). The challenge may be reduced if higher pay influences the quality and productivity of the workforce, which would mean fewer workers and non-labour inputs required to deliver public services.

The devolution of further powers to the Welsh Government, including responsibility for teachers’ pay and conditions and the introduction of a Welsh rate of Income Tax from April 2019 onwards mean that the public sector pay bill, the Welsh workforce and, by extension, the Welsh tax base have become increasingly salient topics in recent years.

Ultimately, trends in Welsh public sector earnings will have a direct impact on cost pressures on the Welsh budget and the relative performance of the devolved tax base. This makes it more important than ever to look at trends in the public sector workforce in Wales.

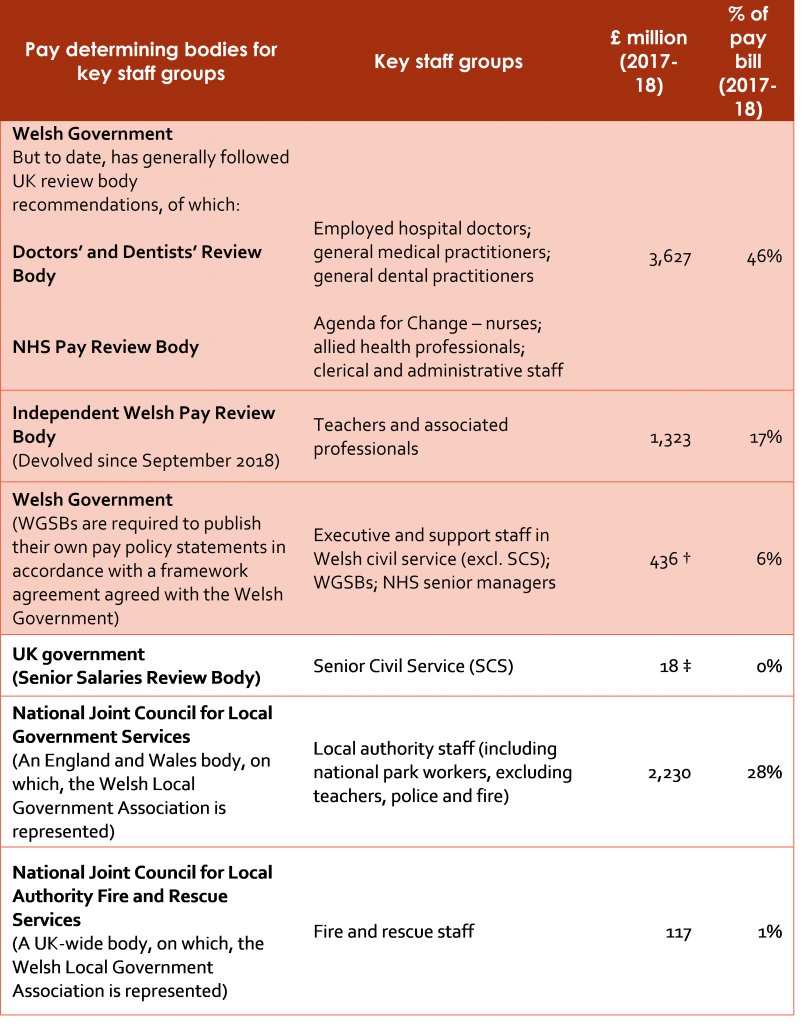

Breakdown of the Welsh pay bill by key pay-determining bodies

Items shaded red are devolved

The Wales Fiscal Analysis team has recently produced a short report examining trends in the public sector workforce and pay bill in Wales. The full report is available for download here.

- December 2025

- November 2025

- October 2025

- September 2025

- June 2025

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Reform UK

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections