What does the mini-budget mean for Wales?

23 September 2022Today's not-so-mini-budget included the largest tax give-away of any fiscal event in fifty years. In this blog post, the Wales Fiscal Analysis team take stock of what was announced, what wasn't announced, and some of the implications for Wales.

Tax cuts

Some of the tax-cutting measures unveiled today had been heavily trailed before the Chancellor’s address, including the decision to reverse the Health and Social Care Levy and scrap the planned rise in corporation tax.

Even so, there were still some surprises – not least the sheer volume and scale of policies announced.

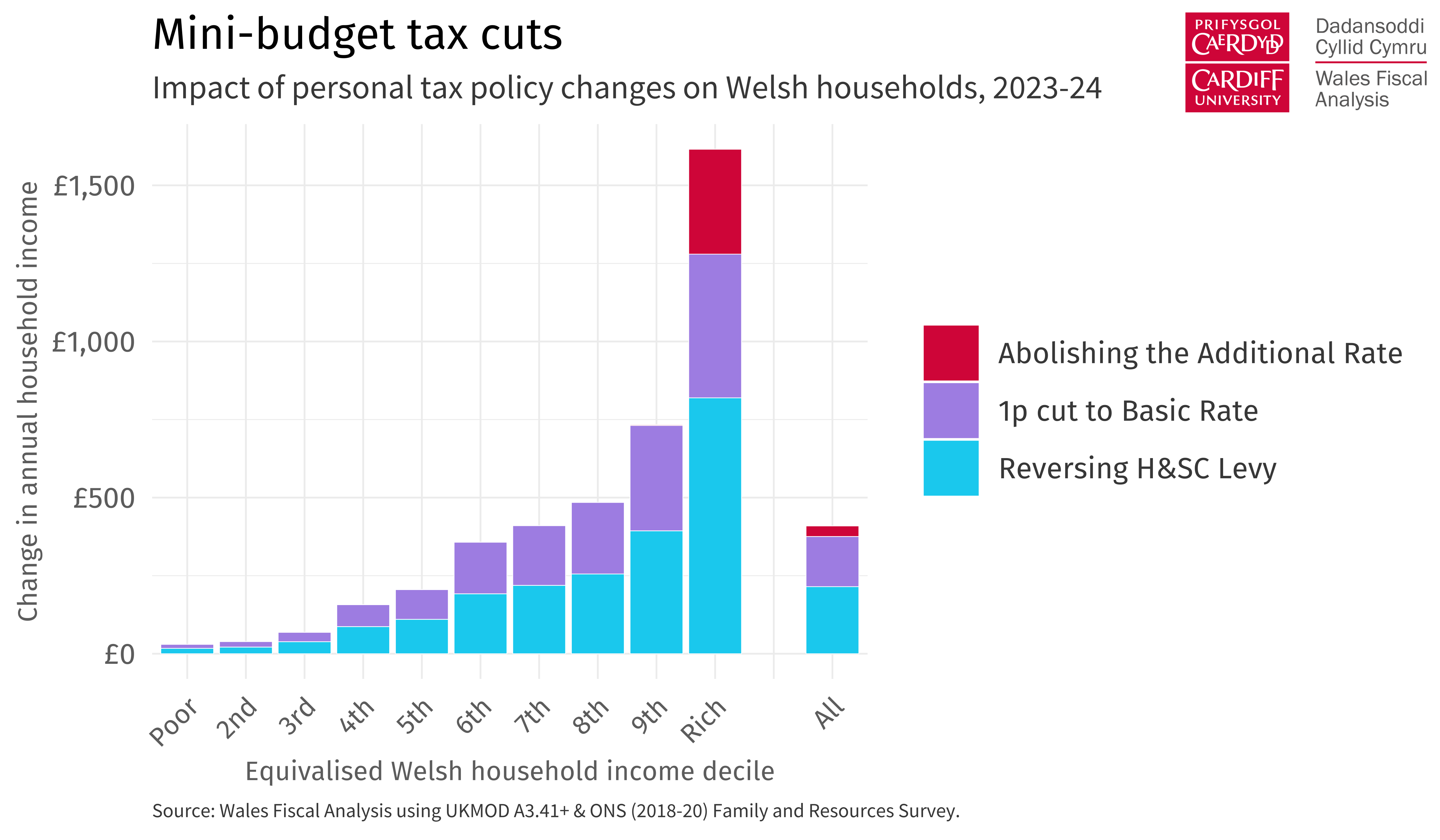

Not only was the planned 1p cut to the basic rate of income tax brought forward a year, but the top (45%) rate of income tax will now be abolished altogether. From April 2023, the 9,000 additional rate taxpayers living in Wales (those earning more than £150,000 a year) will benefit to the tune of £45 million (£5,000 each on average) from this policy alone.

The average Welsh household might expect to save a somewhat more modest sum of £400 next year.

The distribution of these gains across the income distribution in Wales is highly uneven.

Nearly 90% of the gains from the personal tax cuts announced today will go to households in the top 50% of the income distribution. The richest 10% of households alone will see 40% of the gains.

Whilst it is true that any cut to payroll taxes will mostly benefit higher earners – a marker of the progressivity of the UK tax system – the decision to prioritise such large tax cuts at a time when government budgets are being squeezed by high inflation will raise more than a few eyebrows.

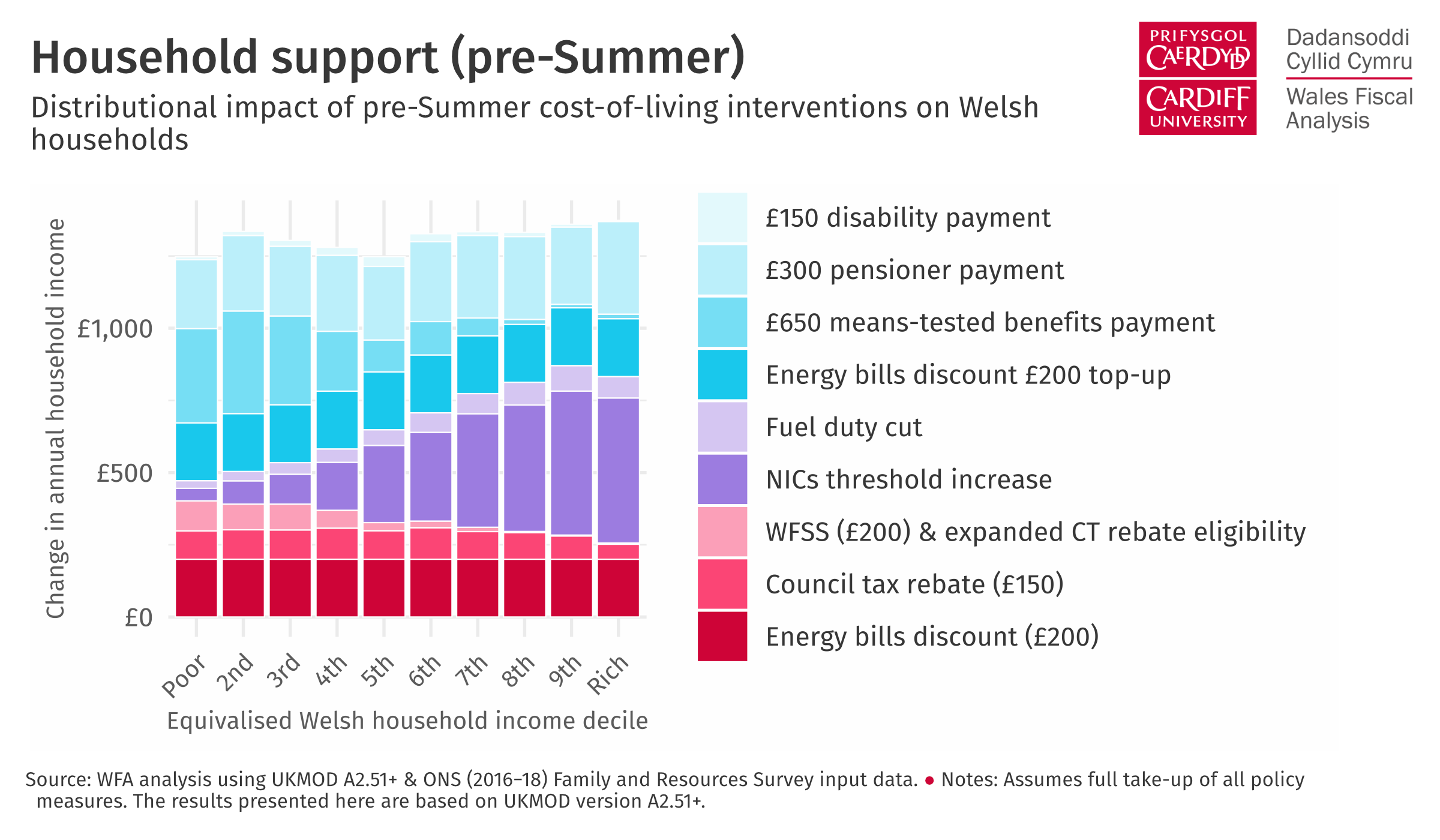

It also marks a significant departure from the UK government’s policy announcements pre-Summer, which provided broadly equal support to households across the income distribution in Wales.

While the £2,500 “price cap” announced earlier this month will provide some reprieve to poorer households, the cost of energy will remain twice as high as it did three years ago. And without a repeat of the targeted payments made earlier this year, the tax cuts announced today will do little to alleviate the impact of rising prices on poorer households during the next fiscal year.

Block Grant Adjustments and devolved taxes

Since Stamp Duty has been replaced by Land Transaction Tax in Wales, the UK government’s decision to cut this tax will not apply in Wales. But by reducing revenues in England and Northern Ireland, the tax cuts reduce the Block Grant Adjustment (BGA), thereby increasing funding for the Welsh Government.

By our calculations, the UK Stamp Duty cuts increase the Welsh budget by £16m this year, and by about £30m a year thereafter. The Welsh Government can decide whether to spend this modest additional funding or implement a similar tax cut in Wales.

In the case of income tax, the tax cuts implemented by the UK government will apply to the reserved portion of income tax paid by Welsh taxpayers. Since thresholds are reserved, the abolition of the additional rate means the Welsh Government will no longer be able to set a specific Welsh Rate of Income Tax for those earning over £150,000. But this will not change the total amount of devolved revenues, presuming the Welsh Government would have maintained a 10p rate in each band in 2023-24.

In theory, the UK government’s tax changes should also not change the size of the BGA, since total comparable UK government revenues have not changed. However, the 2016 Fiscal Framework Agreement introduced separate BGAs for each band of income tax (basic, higher, and additional). Revenue from each band attract a different ‘comparability factor’ in the BGA calculation, reflecting tax per head in Wales as a proportion of tax per head in England and Northern Ireland at the point of devolution (80% at the basic rate, 38% at the higher rate, and 11% at the additional rate).

This means that as comparable UK government revenues are moved from the (now-abolished) additional rate to the higher rate, the associated comparability factor would increase. We estimate this increases the total value of income tax BGAs – and therefore reduces the Welsh budget – by approximately £156 million.

This hit to the Welsh budget would represent a policy ‘spill-over’ effect, with the decision of the UK government having a direct effect on the Welsh budget. This should either lead to a change in the BGA calculations or should result in a compensatory transfer from the UK government to the Welsh Government. A precedent for this was set recently when the UK government transferred £375 million to the Scottish Government after a long-running dispute about BGA calculations.

What wasn’t announced?

There were a few important omissions from the otherwise lengthy list of fiscal announcements. One of which was the prospect for tailored support for businesses and charities beyond March. There was nothing said on Business Rates in England, which would have impacted funding for Wales. Some businesses will face big increases to their tax bills from April as temporary reliefs end and the multiplier is set to increase in line with inflation.

The biggest omission of all was new funding for public services. Since the block grant was set in cash terms back in October last year, rapidly increasing inflation has significantly reduced the projected real terms increase in Welsh Government spending. Based on the Bank of England’s August inflation forecasts, we estimate it could take an additional £800 million to restore the real terms value of the 2024-25 budget for day-to-day spending.

The Energy Bill Relief Scheme will provide relief from higher energy costs for schools, hospitals, and other public services until April. Reversing the rise in employer National Insurance Contributions will also mean Welsh public services spending around £80 million to £90 million less in employer costs from next year, freeing up funding for other purposes.

However, it would require the UK government to revisit its cash-terms spending plans to avoid massive funding pressures for public services over coming years. Given the scale of tax cuts made today, this seems increasingly unlikely.

The government says it is still committed to fiscal sustainability and reducing debt as a proportion of GDP over the medium-term. Achieving these goals in the context of today’s tax cuts would suggest large public spending cuts over the medium term of around £35 billion.

With many public services already in crisis and facing huge post-pandemic pressures, the outlook for the Welsh budget is grim. Alongside the huge distributional impact of today’s tax cut announcements, this outlook also warrants a renewed conversation around using the Welsh Rates of Income Tax over coming years.

***

The Wales Fiscal Analysis team will be publishing a report examining the scale of cost pressures faced by households, industry, public services, and third-sector organisations in early October.

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections