Health by a thousand cuts? An initial analysis of the Welsh Government Draft Budget

20 December 2023

On 19 October, the Welsh Government published its Draft Budget for 2024-25. It had additional funding to allocate – but the budget had been significantly eroded by higher-than-expected inflation, with spending pressures being felt across all public services.

Overall, the big surprise was the sheer extent of additional funding found for core NHS services (an 8% increase on existing plans) and Transport for Wales (43%). Existing Local Government funding plans were maintained in cash terms (but are now worth less in real terms), while huge cuts were found across almost all areas of the budget in 2024-25 – a similar story to the updated spending plans for 2023-24 announced on 17 October.

This blog provides some initial thoughts and analysis of the budget.

The economic and fiscal backdrop to this budget was particularly grim…

The economic and fiscal backdrop to this budget was particularly grim. Economic growth is slowing and inflation is set to remain higher for longer. The Chief Economist’s Report estimates that in 2024, average incomes in Wales are projected to be more than 2% below the pre-pandemic levels.

The Autumn Statement used a boost in tax receipts from higher inflation to fund tax cuts, while eroding the real terms value of UK public spending totals (as well as the Welsh budget in the process). However, tax as a share of national income is still set to increase by 4.5 percentage points compared to pre-pandemic levels, primarily because of frozen tax thresholds.

… but an increase in overall funding and good news on devolved taxes

Since the Welsh Government last published indicative spending plans for 2024-25 back in February, we knew there were additional consequentials on their way (worth £306 million). These primarily resulted from UK government increases in childcare spending (Spring Budget 2023) and business rates reliefs (Autumn Statement 2023) in England.

The Welsh Government for next year has been further boosted by improvements in devolved tax forecasts since budgets were first set, a continuation of a (rare) good news story in Welsh public finances. The net effect of tax devolution on the draft budget for 2024-25 (including a reconciliation for previous forecast errors 2021-22) is a positive £294 million, a £67 million improvement compared to February forecasts.

In terms of other resource funding, there has been a slight fall in Non-Domestic Rates revenue (see below), but an increase in the drawdown from the Wales Reserve to £75 million. The budget plans also assume a revenue to capital budget switch of £47 million, which like the £147 million budget switch for 2023-24 announced in October, will require HM Treasury approval.

All in all, the Welsh Government had an additional £424 million to allocate across its day-to-day spending portfolios, relative to existing February plans.

Large increases in NHS spending plans – substantially higher than the growth in health spending elsewhere in the UK – and further funding for Transport for Wales …

The Welsh Government’s update on the financial position for 2023-24 back in October significantly increased spending on the NHS and provided financial support for Transport for Wales.

Following a similar pattern, the additional allocation to the health budget for 2024-25 is similarly massive, and perhaps beyond expectations. Day-to-day spending allocations for core NHS services increased by £725 million, or 8% on top of existing spending plans.

This means the wide Health and Social Services resource budget increases by 4.3% in cash terms, or 2.6% in real terms, relative to revised 2023-24 levels from October’s announcements. This is despite steep cuts to mental health and childcare and play budget lines inside this portfolio.

This means that health spending in Wales is set to grow substantially quicker than UK government plans in England or the Scottish Government plans announced yesterday. The hope will be that this increase provides a more realistic chance of meeting spending pressures facing health services and may allow for a higher increase in NHS pay in Wales, at least matching the forecast in average earnings next year (3.3%).[1]

The draft budget again provides additional funding support for Transport for Wales, with an increase of £111 million (or 43%) on top of existing plans for 2024-25 – only slightly below the additional funding provided in 2023-24 (announced in October).

The explanation for this additional funding has been poor passenger growth and sluggish ticket revenue compared to pre-pandemic projections. However, four UK rail operators have recorded relatively more journeys than before the pandemic by March 2023. This raises questions around the medium-term sustainability of providing additional top-ups to the budget going forward, in what will likely be austere times for the wider Welsh budget.

… but funded by cuts of £422 million in for day-to-day spending plans outside the NHS and Transport for Wales

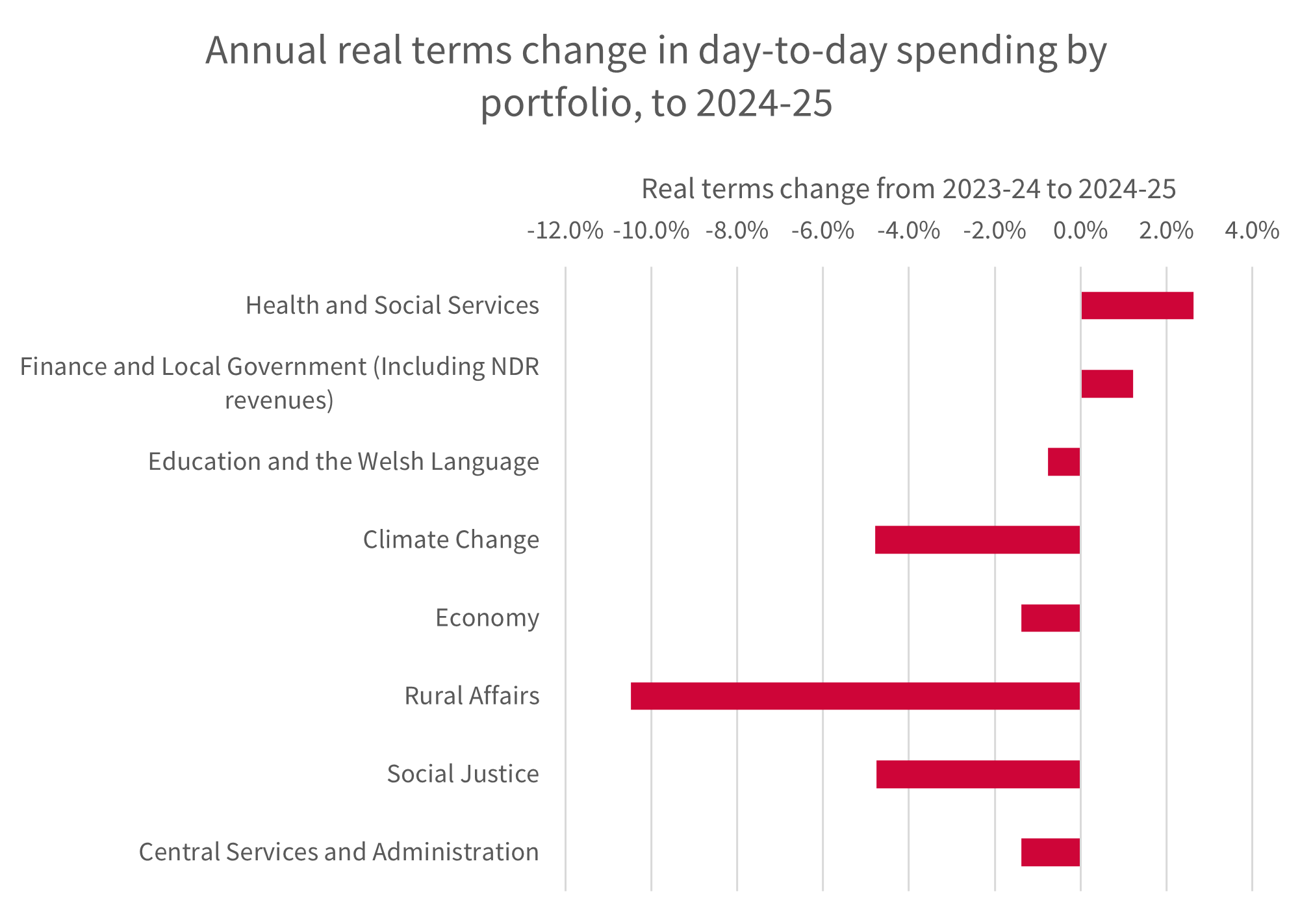

With spending on the NHS and Transport for Wales increasing by far more than the overall increase in the budget, the Welsh Government has significantly cut back on spending across almost all other areas.

Planned spending outside these two areas has been cut by £422 million.[2]

The core Local Government funding settlement has remained untouched from existing plans, which will be somewhat of a relief for local authority leaders. However, the 3.1% cash-terms increase will likely fall short of funding pressures next year, and the medium-term outlook remains ominous.

Meanwhile, spending outside of health, local government and Transport for Wales will fall by 2.8% in real terms next year. This is a cut in spending similar in scale to the annual cuts seen at the start of the 2010s, with potentially more to come if the current spending plans of the UK government are to be believed.

While it will take some time to digest all the details, these cuts will have a damaging impact across a vast list of spending areas and sectors – from arts and culture, environmental protection, transport (outside Transport for Wales), higher education, further education, apprenticeships, to rural investment schemes (amongst others).

While the divergence in devolved tax policy between Wales and Scotland grows starker

The major tax policy announcements in the budget related to Non-Domestic Rates. The Welsh Government decided to cap the NDR multiplier in Wales to 5% for 2024-25, below the 6.7% (September CPI) increase which would usually apply, at a cost of £18 million next year and beyond.

This is different to the UK government which spared smaller businesses from increases to the multiplier but increased rates for larger businesses by 6.7%.

Meanwhile, the Welsh Government announced a 40% NDR relief for retail, leisure and hospitality businesses in 2024-25, down from the 75% provided in 2023-24 (and continued in England in 2024-25), seemingly at a cost of £60 million.

This means the Welsh Government has used some of the consequentials funding from business rates reliefs in England to prioritise public services instead. This brings more in line with the Scottish Government, who have not provided sector-specific reliefs for retail, leisure, and hospitality businesses this year or next.

The wider contrast between the Welsh and Scottish governments on tax has however grown starker.

The Scottish Government has also again used its devolved income tax powers, introducing a new tax band of 45% on earnings between £75,000 and £125,140. Total income tax differences between Scotland and the rest of the UK now raises an additional £1.5 billion for the Scottish budget. On council tax, the Scottish Government has implemented a council tax freeze in 2024-25, funding the equivalent of 5% increases for local authorities.

Meanwhile, Welsh local authorities are likely to significantly increase council tax levels again next year (probably beyond 5.8% seen this year) as they grapple with spending pressures. The Welsh Government again decided not to use its income tax powers, which while more restrictive than the Scottish-style powers, would have provided a more progressive way of increasing revenues for public services next year.

Conclusion – time for an urgent and wide conversation

By increasing health spending to the detriment of all other spending areas, this budget followed a long-standing pattern. Spending outside the health service this year is about 10% lower in real terms than what it was in 2010.

The optimistic case is that this additional funding (way above increases elsewhere in the UK) puts the health service on a more sustainable footing, allowing it to meet funding pressures and offer pay increases to staff that avoids strike action. The UK government’s health spending plans will likely need to be topped up next year eventually.

The pessimistic case, however, is that the health service (and Transport for Wales for that matter) increasingly resembles a budgetary black hole, sucking in an ever-higher share of spending from a stagnating budget.

Ultimately, given the likely spending plans of the next UK government (of whichever stripes), we need an urgent and wide conversation around what other public services we wish to see – and how we pay for them – in Wales.

[1] The presentation of the budget unfortunately makes it impossible to compare core NHS spending with totals for 2023-24 after the October 2023 updates.

[2] This includes £68 million of cuts inside the Health and Social Services budget but outside of core NHS services.

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections