5 key questions for Wales ahead of the UK Spring Statement

17 March 2022

On 23 March, Rishi Sunak will deliver his Spring Statement against the backdrop of heightened uncertainty and rising inflation.

There has been talk of a ‘policy-light’ fiscal event, following on from the huge pandemic-related fiscal response of 2020 and the significant decisions on tax and spending plans made last year. However, recent developments mean the Chancellor will again need to respond to the huge impact on livings standards, public services, and the government finances.

This blog post outlines five of the key questions for Wales and the Welsh Government’s budget ahead of the Spring Statement.

- What’s the outlook for the UK economy and public finances?

Alongside the Spring Statement, the Office for Budget Responsibility (OBR) will outline its latest assessment of the UK’s economic and fiscal outlook. Following a huge fall in 2020, GDP recovered sharply in 2021. The latest outturn data suggest economy is somewhat larger than the OBR were forecasting, with the impact of the Omicron variant being more muted than could have been expected.

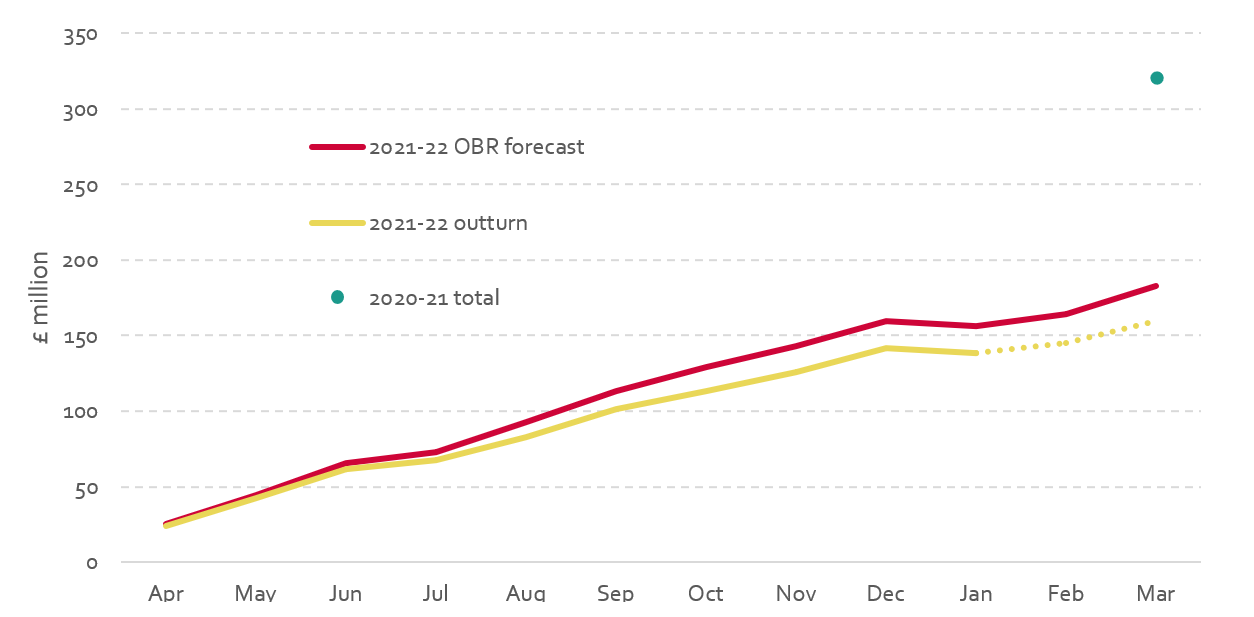

As a result, borrowing has been significantly lower than expected so far this year. Government receipts have surged ahead of forecasts, though this has been slightly offset by higher debt interest payments. If these trends continue in the last two months of the financial year, government borrowing in 2021-22 could be some £23 billion below the forecasted £183 billion.

Figure 1: Cumulative public sector net borrowing in 2021-22 (forecast and outturn)

Source: ONS (2022) Public sector finances, UK: January 2022; OBR (2021) Economic and Fiscal Outlook October 2022; and authors’ calculations

However, this better immediate news may well be offset by a gloomy outlook for growth over coming years. In February, the Bank of England revised down its forecasts for UK economic growth and the subsequent invasion of Ukraine is likely to further damage real growth prospects.

Another key uncertainty is the forecast for inflation. In October, the OBR forecasted CPI inflation peaking at over 4% in the second quarter of 2022. By February, the Bank of England forecast inflation to peak at over 7%, even before considering the impact of the war in Ukraine.

Higher inflation will further push up debt interest payments over coming years and expected interest rate hikes could add a further £11 billion (see IFS presentation).

For the overall forecast for public finances, the key aspect of the OBR’s forecasts will be their judgement on whether the buoyant revenue trends of 2021-22 continue into future years, and the extent to which these may offset the gloomier economic outlook.

In any case, given the huge forthcoming hit to household finances and public services, there is a strong case for the UK government to temporarily suspend its fiscal rules to allow an adequate fiscal response.

- Will there be further support for households?

Given the outlook for inflation outlined above, there is an urgent case for further fiscal support for households in the Spring Statement. The Minister for Finance and Local Government, Rebecca Evans, argued it was an opportunity for the UK government to “step up”, while there have been calls from across the political spectrum for tax cuts and benefit increases.

Protecting the real value of benefits in 2022-23 would be the most targeted way of supporting struggling households, while delaying the planned increase in the National Insurance rate would benefit better off households the most.

The UK government announced a package of £9 billion in February, which was expected to offset half of the then-expected increase in UK domestic energy costs of £18 billion. The eventual increase in costs next year could now reach £43 billion.

UK government measures applying in Wales include the £200 Energy Bill Discount Scheme (recouped over future years) and the expansion of the Warm Home Discount.

In addition, the Welsh Government has allocated nearly £340 million towards cost-of-living measures, significantly more on a per-person basis than equivalent UK government measures.

In a briefing report published last week, we found that even after compensating measures, the average Welsh household would be still £600 worse off from April (even before considering non-fuel inflation). Despite the Welsh Government’s targeted support, Welsh households in the poorest income decile will see the largest reduction in their disposable income (of 4%).

- Will there be further funding for the Welsh budget?

Inflationary pressures will also greatly affect the Welsh Government’s final budget plans, which were published on 1 March.

Last autumn, the Welsh budget benefitted from two large upward revisions in the UK government’s spending plans. Relative to core funding in 2021-22 (excluding Covid-19 funding), funding for day-to-day spending on public services would grow by £2.0 billion in 2022-23, and by £2.8 billion by 2024-25.[1]

With Covid-19 funding dropping to an average of just £136 million a year over the next three years, total funding will be lower than mid-pandemic levels. Any Covid-related pressures over future years will need to be funded from within the (now-larger) core budget.

Still, the Spending Review block grant settlement was a substantial upgrade on previous projections (based on March 2021 spending plans) and the Welsh Government appeared to be in a position to meet most of its funding pressures and fund the policies contained within the Cooperation Agreement with Plaid Cymru.

However, rising inflation over recent months has eroded the real spending power of the Welsh Government and made the cash-terms block grant settlement substantially less generous.

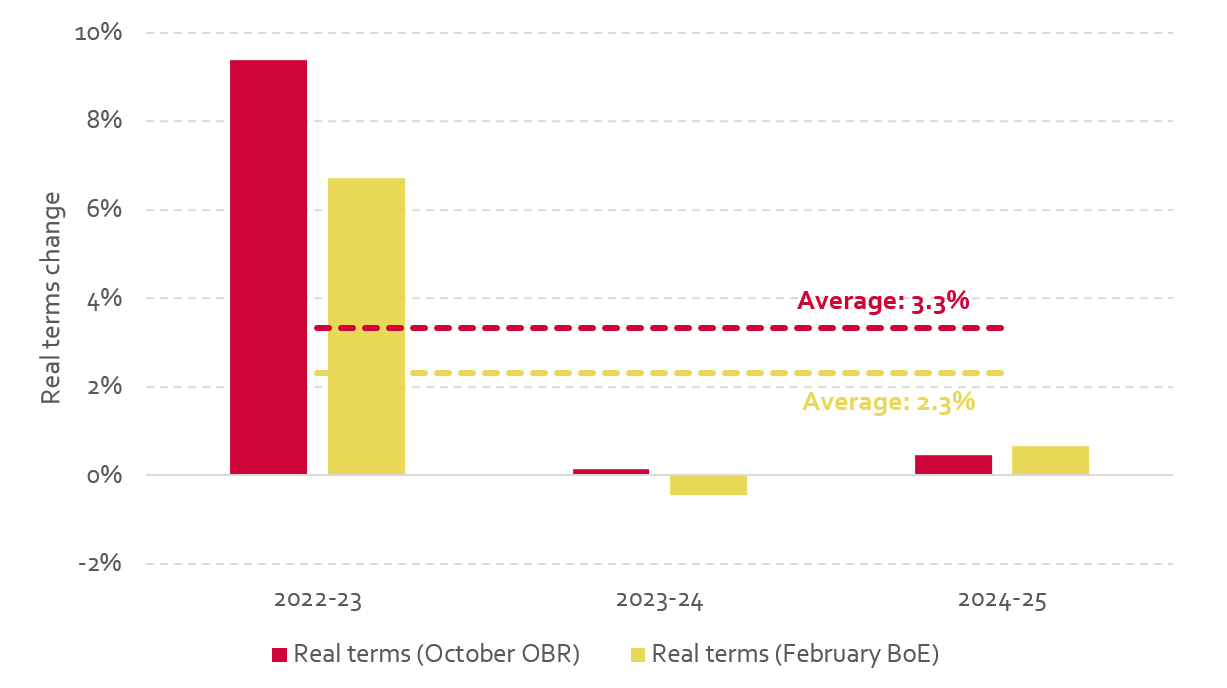

Figure 2 shows the real terms change in total day-to-day spending allocations made by the Welsh Government in its Final Budget plans, using the OBR’s forecast inflation (from October 2021) and the most recent forecasts from the Bank of England (February 2022).[2]

Whereas spending was set to increase by 9.4% in real-terms next year (from the 2021-22 Final Budget baseline), the real-terms increase is now set to be 6.7% in 2022-23 and set to fall slightly in real terms in 2023-24. Over the three years of the Spending Review period, higher inflation wipes out almost a third of the planned real increase.

Figure 2: Real terms change in allocations for day-to-day spending on public services (Final Budget 2022-23)

Source: Welsh Government (2022) Final Budget 2022-23; Office for Budget Responsibility (2021) Economic and Fiscal Outlook October 2021; Bank of England (2022) February 2022 Monetary Policy Report; and authors’ calculations

Rising inflation will have an impact across all areas of spending.

Final Budget plans for the NHS included an additional £1.3 billion of day-to-day funding by 2024-25 – a planned 8.5% real-terms increase based on the October inflation forecast. Using updated inflation forecasts, this increase would now be below 5.5% over three years, at a time of huge post-pandemic pressures.

As an example of increasing cost pressures, the Welsh NHS spent over £50 million on energy in 2019-20.[3] Given recent and projected energy price increases, this alone could create roughly £50 million of additional cost pressures on budgets next year.

Another pressure relates to public sector pay. Rising inflation strengthens the case for higher pay awards next year, especially in the context of the need to attract and retain staff during the Covid-19 recovery and after a decade of real terms cuts in pay.

Pay awards will be set later in the year but will be influenced by the budget context laid out next week.

For example, a 5% pay award would cost an extra £275 million for the Welsh NHS and would account for well over one-quarter of the planned NHS cash budget increase. This award would still be significantly lower than forecast CPI inflation.

These concerns over cost pressures (in pay and other inputs) apply equally to local authority services. The £438 million increase in the local government settlement in 2022-23 represented a 6.5% real-terms increase based on October forecast inflation – this would fall to 3.9% based on February forecasts.

The impact of higher inflation on the Welsh Government’s budget outlook will depend on whether the UK government changes its own nominal spending plans in response. Based on February inflation forecasts (before the invasion of Ukraine), the Chancellor would need to announce an additional £550 million a year of funding for Wales to get the same real terms increase in the resource block grant as he announced back in October.

- More good news on devolved tax forecasts?

The OBR will also publish its updated forecasts for devolved revenues. Part of the projected growth in the Welsh Government’s spending power over coming years was down to strong forecast growth in devolved revenues, faster than the forecast growth in equivalent UK government revenues in England and Northern Ireland. This faster growth provides a boost to the Welsh Budget, currently projected to be worth £200 million a year by 2024-25.

However, these projections are only based on forecasts which will inevitably change. Any revisions which disproportionately affect forecasts of Welsh revenues could have an impact on the Welsh budget outlook.

- Whither the Shared Prosperity Fund?

Finally, we could see all the details on the Shared Prosperity Fund (SPF) being published alongside the Spring Statement.

Alongside the Levelling Up white paper in February, the government published its pre-launch guidance for the fund which was first mentioned in the 2017 Conservative Party manifesto as a replacement for EU structural funding. It committed to publishing a full prospectus on the Fund and how it will operate in the spring.

The first point of interest for Wales will be the amount of funding allocated to Wales. Nearly a quarter of the Community Renewal Fund (the precursor to the SPF) was allocated to Welsh projects in 2021-22. A similar share of the SPF once it is “ramped up” to £1.5 billion a year by 2024-25 may fulfil the Conservative manifesto pledge to fully replace EU funding. In the meantime, however, the Welsh Government argues it will lose around £750 million over three years (2021-22 to 2023-24) relative to what would have been allocated from Structural Funds.

Secondly, we’ll find out what role (if any) the Welsh Government will play in the implementation of the fund. The UK government is committed to “working with devolved administrations”, but it’s likely to be a much-diminished role for the Welsh Government compared to how EU structural funding operated.

[1] Figures reflect the block grant before accounting for Block Grant Adjustments.

[2] Public spending is typically adjusted for inflation using the GDP deflator rather than the CPI inflation rate forecasted by the Bank of England – we assume the GDP deflator will increase by the same amount as the CPI.

[3] Based on reported figures given in annual reports of NHS boards and trusts in 2019-20.

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections