We Need to Talk About Council Tax: The Regressive Welsh Way of Raising Taxes

4 September 2025By Guto Ifan, Ed Gareth Poole and Owain Cynfab

Back in April, households across Wales started paying their council tax bills for 2025-26. The average 7.3% increase in these bills all added to overall cost-of-living increases in “Awful April”[1] – a month that simultaneously saw increases in council tax, TV licence fees, energy, and water bills.

Recent reports suggest the UK government is considering major reforms to property taxation in England in the run up to the Autumn Budget, recognising that the current approach to funding local government is outdated and unviable.[2]

But in the Welsh context, there’s an equally important story to tell. Since the start of devolution, council tax has been increased time and time again to fund local services to a much greater extent than in Scotland and England. And not just for council services, but for the four police and crime commissioners as well.

In this blogpost we’ll explain why Council Tax is much more regressive than Income Tax – and why Wales’s reliance on this tax to raise money is an outlier in the UK. This is a longer post than normal; but there’s lots of crucial detail. In it we find:

- Council Tax continues to rise well above inflation: Welsh council tax rates for 2025-26 increased by an average of 7.3%, the second consecutive year of increases exceeding 7%

- Wales is the UK outlier: Since devolution in 1999, Welsh council tax bills have effectively tripled in nominal terms. Wales has averaged annual increases of 5%, compared with 4% in England and just 2% in Scotland

- Council Tax is offsetting austerity: Welsh council tax revenues are now £440 million higher than if they had increased in line with England since 2010-11, and £750 million higher than if Wales had followed Scotland’s trajectory

- Regressive Impact: Compared with Income Tax, council tax is fundamentally regressive and disproportionately burdens lower-income households with the cost of tax rises

- Household income impact: Welsh council tax bills now consume 3.5% of average household income compared with just 2.5% in Scotland – a significant difference that particularly affects poorer households

- Council Tax is plugging gaps in police funding: Even though policing is ‘non-devolved’ and primarily funded by the Home Office, police precepts added onto council tax bills in Wales have increased much faster than in England since 2010, cumulatively boosting Welsh police force budgets by £466 million compared with forces in England

- Tax reform delayed: Despite Welsh Labour’s 2021 manifesto commitment to reform council tax for greater fairness, revaluation has been postponed from 2025 to 2028. Political parties now need to be clear on how they will square the circle of continuing inflation-busting demands on council services on the one hand, and who’ll be expected to bear the burden for such cost increases on the other

1. The state of play on Council Tax

With an average increase of 7.3%, 2025-26 marks the second consecutive year of historically high Council Tax increases averaging over 7%. Every local authority in Wales implemented increases above 5%, with Pembrokeshire voting in the steepest rise at 9.25%.

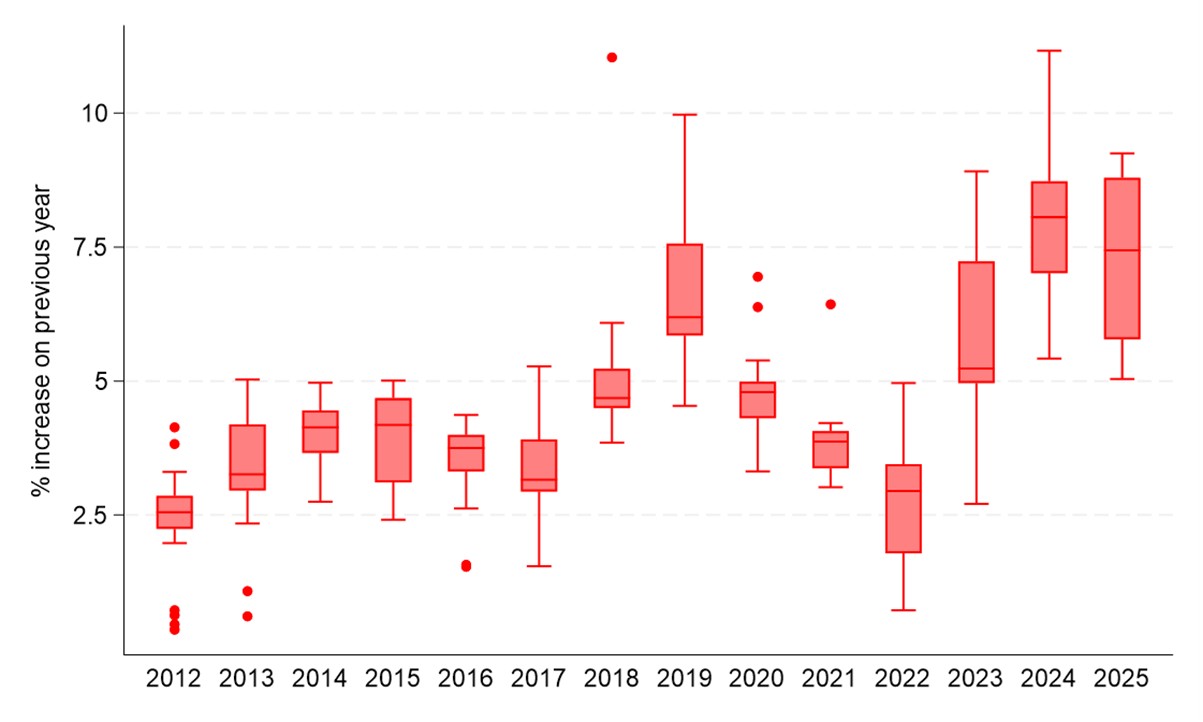

As we’re currently in the middle of the five-year local government election cycle (2022-2027), this shouldn’t be surprising. Figure 1 shows Band D council tax increases by depicting the range of increases enacted across the 22 local authorities. There’s sufficient evidence now that Council Tax increases are higher in the middle of local government electoral cycles and lower during election years (2012, 2017, and 2022).

Figure 1: Average Band D Council Tax increases across Wales’ 22 local authorities since 2012

Source: Average Band D council tax by billing authority, StatsWales[3]

2. What’s Driving These Increases?

Spending pressures for local councils are enormous and continue to grow. In England, several large local authorities including Birmingham and Nottingham city councils have effectively declared bankruptcy by issuing Section 114 notices, and nearly 20 councils[4] are expected to reach this point in 12 months’ time. In Wales, while no council has reached this point, the Welsh Local Government Association had projected spending pressures of £559 million for 2025-26.

The 2025-26 Welsh Government Draft Budget responded to these pressures by allocating an additional £253 million for core funding, plus a baseline increase of £131 million for pay and pension costs, plus £15 million extra support for social care. The Final Budget for 2025-26 also added £8 million to implement a funding floor for all local authorities.

We estimate that the Council Tax increases approved by the 22 Welsh local authorities should generate approximately £151 million in additional revenue, once we adjust for the Council Tax Reduction Scheme.[5] When combined with Welsh Government funding increases, this basically matches the projected spending pressures (around £558 million total versus the £559 million in forecasted pressures).

This should forestall the need for significant cuts to council budgets this year, though the situation will vary between different councils and between different service areas.

3. How Does Wales Compare with our Neighbours?

Looking just at the very recent history of council tax increases, this is the second consecutive year in which Welsh council tax increases exceed those in England, where increases over 5% typically require a local referendum. Wales’ increases this year are below Scotland, where councils raised taxes by an average of 8.8% this year.

But taking a longer-term view, the pattern in council tax increases since devolution is much more one-sided and can be starkly and simply shown.

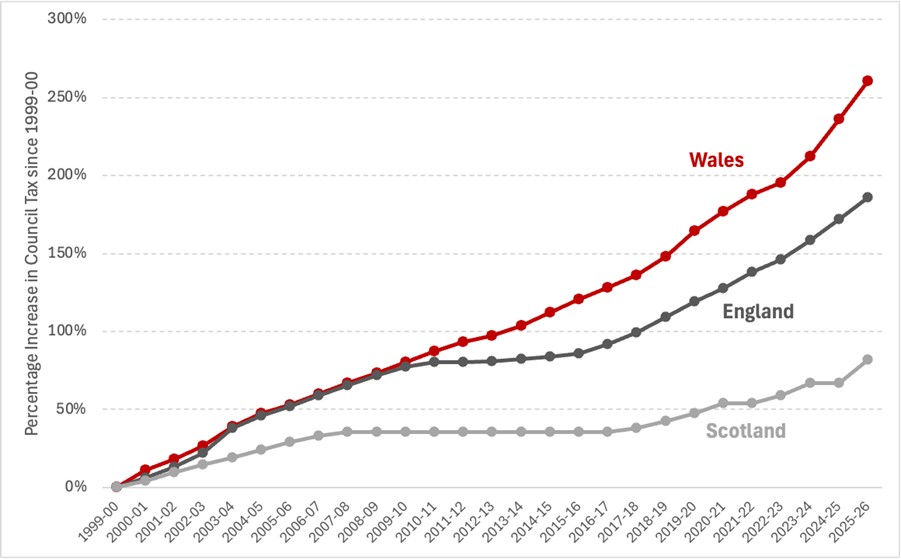

Figure 2: Average increases in average Band D Council Tax rates since 1999-00 in England, Scotland and Wales

Source: UK, Scottish and Welsh Government official statistics[6]

Since the advent of devolution in 1999, Wales has seen average annual council tax increases of 5%, compared with 4% in England (with increases constrained by caps and referendum requirements since 2010) and 2% in Scotland (due to the Scottish Government’s council tax freeze policy since 2007-08).

This means that Welsh council tax bills have effectively tripled since devolution, with notably faster increases than England and Scotland since the start of UK austerity measures in 2010. In 2025-26, council tax revenues are now £440 million higher than they would have been had they increased in line with England since 2010-11, and £750 million higher than if we had followed Scotland’s trajectory of council tax increases. These are serious sums of money in Wales.

Over the Sixth Senedd term as a whole (2021-22 to 2025-26), council tax revenues will have increased by over £600 million – £233 million higher than if bill increases had followed Scotland.

4. The Regressive Reality

The Welsh Government would have a straightforward explanation for these increases. By allowing higher council tax rises, Wales has avoided council bankruptcies and has kept vital services like adult and children’s social care and ALN provision in a stronger state than across the border.

This extra resource does of course help fund local services. But the problem is that by choosing council tax as the vehicle for providing this extra resource, tax increases have hit Welsh households very unequally.

Unlike income tax, council tax does not tax households based on their income, nor on the current value of their property. Instead, council tax bills are based on the valuation bands which are roughly based on how much a given property was worth in April 2003 (when the last revaluation was undertaken in Wales). There are nine bands, with A representing the lowest value properties and I the highest. But even though they cover every type and size of property imaginable, rates for bands A-C and E-I vary only quite narrowly around the central band D rate, regulated by a Welsh Government-set formula.

This limited variation around the Band D rate set by the council means households living in Band A-C properties pay a much higher proportion of the value of their house in council tax than households living in a Band H-I property.

When assessed against household income, this also results in poorer households paying a greater share of their income in council tax than richer households.[7] Across the UK, council tax takes approximately 5% of income from households in the bottom income decile, compared to less than 2% for those in the top decile.[8]

Welsh tax policy has exacerbated this squeeze. Council tax revenue now equals 2.5% of Wales’s GDP, compared with 1.8% in England. Average council tax bills as a share of Welsh gross disposable household income since devolution have increased from 1.8% in 1999-00 to 3.5% in 2024-25.[9] If you looked askance at your council tax bill last month you’re not alone. At 3.5% of average gross disposable household income (and much more for poorer households), Welsh council tax bills are fully one percentage point higher than the 2.5% of gross disposable household incomes in Scotland.

This isn’t because Barnett “overfunds” Scotland. The use of council tax or income tax to squeeze money out of taxpayers is a straightforward trade-off and a political choice. Tax policy is now probably the biggest policy divergence between Wales and Scotland: while the Scottish Government has repeatedly raised income tax rates for middle and higher earners and created new bands of income tax, the Welsh Government has never used its powers over the Welsh Rates of Income Tax.

Even raising the Basic Rate of Income Tax would be a much more progressive means to pump money into the system than the policy currently chosen for Wales. This is because income tax increases take a proportionally smaller share of additional income from lower earners compared with higher earners.

5. The Police Precept Problem

Council Tax for local authorities isn’t the only point of divergence. Flying completely under the radar are the increases in the Police Precept in Wales – the additions to council tax set by the four Police and Crime Commissioners that are tacked onto council tax bills. Even though policing is non devolved, these precepts now consume a greater share of your total council tax bill than they did in 2010-11. And they have increased much faster than in England.[10]

Welsh police budgets in 2025-26 are now £65 million higher than had precepts risen in line with England since 2010-11. Over the past fifteen years, thanks to these increases on Welsh council tax bills, Welsh police forces have received more than £466 million in funding than they would have if precept increases had matched England’s since 2010.

In a context where the Westminster government has resolutely refused to devolve policing and justice, it’s ironic that a Welsh devolved tax is offsetting tighter Police Grant settlements – the grant funding that Wales’ four police forces receive directly from the Home Office.

6. Tax Reform Postponed

The 2021 Welsh Labour manifesto committed to “reforming council tax to ensure a fairer system for all“. And elsewhere in the UK the Welsh Government has been credited with exploring options for reform.[11]

But the postponement of revaluation and reform until 2028 – rather than April 2025 as originally planned – is disappointing. With the old system still in place, Wales’s rapid increases in Council Tax bills will likely continue, disproportionately affecting poorer households in Wales.

With eight months to go until the next election, we’re at the point where the rubber hits the road on tax policy. Every party will want to protect local government services – but how?

At a minimum, political parties will need to clarify whether they plan to proceed with the scheduled revaluation in 2028. The revaluation will inevitably create both winners and losers as properties are reassigned to higher or lower tax bands.

But equally important will be commitments to reforming the system, with options ranging from minimal reform to the structure of Council Tax, to a 12-band proportional system.[12]

7. Conclusion: Time for Honest Conversations

In the run up to the 2026 election, we’re facing a critical crossroads in our approach to funding local government services and – despite being a supposedly reserved competence – the police. The current reliance on council tax – a fundamentally regressive way of raising money that places disproportionate burden on those least able to pay – represents a policy choice, not an inevitability.

Postponing revaluation until 2028 means another three years of a system that’s increasingly out of touch with the reality of households struggling to make ends meet. With a Senedd election on the horizon, voters deserve honest answers about how our new Welsh Government intends to fund local services in the future – whether through continued council tax increases, more progressive (but politically difficult) income tax changes, or a complete overhaul of local government finance.

What’s clear is that the historic path of relying on inflation-busting council tax increases to reinforce local services is now unsustainable for the poorest Welsh households.

[1] ‘Awful April’: bill rises Britons face, from council tax to energy and cars. The Guardian, 31 March 2025 https://www.theguardian.com/money/2025/mar/31/awful-april-bill-rises-council-tax-energy-tv-licence-car-tax

[2] Reeves considers replacing stamp duty with new property tax. The Guardian 18 August 2025

Reeves considers replacing stamp duty with new property tax | Tax | The Guardian

[3] Data available at https://statswales.gov.wales/Catalogue/Local-Government/Finance/Council-Tax/Levels/averagebanddcounciltax-by-billingauthority

[4] Nearly 20 councils in England ‘at risk of insolvency’ due to Send costs. The Guardian, 30 March 2025: https://www.theguardian.com/education/2025/mar/30/councils-england-insolvency-risk-send-costs

[5] Specifically, this relates to County Councils’ and Community Councils’ tax bills increasing by 7.1%.

[6] Data for England: https://www.gov.uk/government/statistical-data-sets/live-tables-on-council-tax; Wales: Average band D council tax, by billing authority; and Scotland – Council tax datasets – gov.scot

[7] See Figure six here: https://www.gov.wales/sites/default/files/publications/2018-06/welsh-tax-policy-report.pdf

[8] Rising Council Tax bills and the spectre of the poll tax • Resolution Foundation Note: quoted figure for the bottom decile refers to households between the 5th and 10th percentile of household income.

[9] We assume here that GDHI per person for Wales has grown in line with the rest of the UK for more recent years – data for these years has not yet been published.

[10] Data available at: https://www.gov.uk/government/statistical-data-sets/live-tables-on-council-tax

https://assets.publishing.service.gov.uk/media/5a78ac7be5274a277e68e91d/1870215.pdf

https://assets.publishing.service.gov.uk/media/5a78ac7be5274a277e68e91d/1870215.pdf

https://assets.publishing.service.gov.uk/media/5a75b12240f0b67b3d5c8777/2141660.pdf

Annual increase in average band D council tax, by tier

[11] ‘Depressing’ that Scotland is behind Wales on council tax reform, MSPs told. STV News, 18 February 2025 https://news.stv.tv/scotland/depressing-that-scotland-is-behind-wales-on-council-tax-reform-msps-told

[12] See Institute for Fiscal Studies analysis of reform options here: https://ifs.org.uk/publications/assessing-welsh-governments-consultation-reforms-council-tax

- December 2025

- November 2025

- October 2025

- September 2025

- June 2025

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Reform UK

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections