Spending Review 2025 – the implications for Wales

12 June 2025

By Guto Ifan, Owain Cynfab and Ed Gareth Poole

On 11 June, Chancellor Rachel Reeves outlined the UK government’s detailed spending plans.

While the announcement of rail funding dominated the headlines in Wales, the Spending Review provided crucial detail on the outlook for Welsh Government spending. This will set the fiscal context for next year’s Senedd election and much of the preceding political debate.

This blog looks at the implications of yesterday’s announcements.

The outlook for the Welsh Government budget

The return to a multi-year spending review provides welcome clarity on the medium-term outlook for the Welsh Government budget. The block grants for day-to-day spending have now been set to 2028-29 and the capital block grants up to 2029-30.

Crucially, this will provide a firmer basis for assessing party manifesto plans at next year’s election.[1]

The block grant for day-to-day spending will grow by around 1.2% per year in real terms on average from this year to 2028-29.[2] After accounting for faster growth in devolved taxes – relative to the corresponding Block Grant Adjustments – we estimate that day-to-day spending will grow by approximately 1.4% per year in real terms on average.

Meanwhile, the capital block grant will grow again in real terms next year, before falling quite significantly over subsequent years. Overall, the capital block grant will be approximately 3.6% lower in 2029-30 than in 2025-26.

The choices facing the Welsh Government

The UK government plans to increase day-to-day spending on the NHS in England by 3% per year in real terms over the next three years. This has triggered the lion’s share of additional funding for the Welsh Government: we estimate that consequentials deriving from NHS and schools spending in England equate to around 91% of the additional funding announced for the Welsh Government in 2028-29.

Passing on these consequentials to equivalent services in Wales would still leave NHS funding growing at below its long run historical average (3.6%). But this would still see other services facing tight budgets over coming years, leaving them – at best – flat in real terms.[3]

Following the pattern of recent years, the funding is also frontloaded, with faster growth in spending in 2026-27 followed by leaner budgets in 2027-28 and 2028-29.

This is good news for the current Cabinet Secretary for Finance, who may be able to avoid having to cut services in next year’s budget, which will need to pass through the Senedd a matter of months before the election.

It’s worse news for whomever is Cabinet Secretary after the election, who could face the prospect of having to cut non-NHS spending by 1.4% per year in real terms in 2027-28 and 2028-29.[4]

The block grant settlement in historical context

The Spending Review calls the block grant settlement “the largest settlement in real terms since devolution in 1998”. Given the propensity of public spending to grow over time, this is not a significant claim.

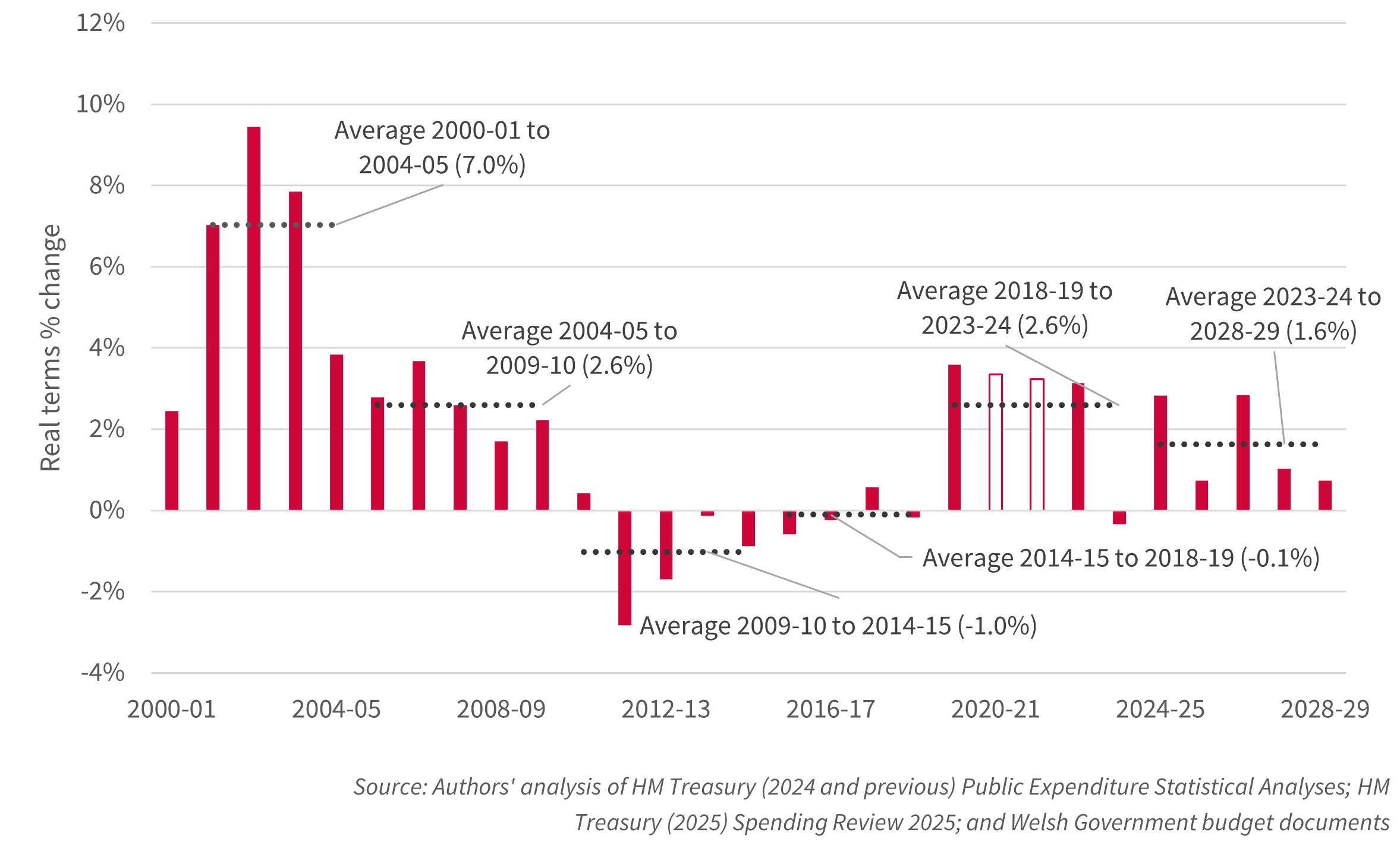

Taking a longer-term view, over the current UK parliament (from 2023-24 to 2028-29), the Welsh Government budget for day-to-day spending will grow by 1.6% per year in real terms on average. This compares with 2.6% annual growth in real terms over the course of the previous parliamentary term (from 2018-19 to 2023-24).[5]

Therefore, although Labour have significantly increased departmental spending relative to their manifesto spending plans, there has not been a big change of course in the path of spending on public services since they came to office. As seen in Figure 1, this is the slowest growth in Welsh Government day-to-day spending outside of the austerity parliaments of the 2010s.

Figure 1: Average annual change in Welsh Government day-to-day spending, 2000-01 to 2028-29

Rail funding

The Chancellor announced £445 million over ten years for rail infrastructure enhancements in Wales. It was later clarified that £348 million would be spent over the current Spending Review period (2026-27 to 2029-30), with £48 million of this relating to enhancements on the Core Valley Lines.

While any additional investment in Wales’ rail network is welcome, as we outlined yesterday, this quantum of funding is underwhelming. Contrary to comments made after the announcement, this funding does not come close to compensating Wales for the loss incurred from HS2, which will grow to £845 million by 2029-30 (with far more to come over subsequent Spending Review periods).

Professor Mark Barry has noted that, “to be comparable with England, Wales needs … circa £250 million per annum for enhancements on both the CVL and the NR network in Wales for 15 years”. This announcement falls far short of this. It also leaves the systemic problems with how Welsh rail infrastructure spending is funded in place.

Welsh Government ministers and officials no doubt worked extremely hard to ‘win’ this additional investment for Wales. However, if this is what counts as a success, it merely underlines the problems with the current system.

Coal Tip Safety and the new local growth fund

The biggest win for the Welsh Government from yesterday’s announcements would be the funding for coal tip safety. The £118 million new spending over three years, on top of the funding announced back in the autumn, looks broadly in line with estimated long-term costs of the problem.

On post-EU structural funding, there was some good news on the quantum of funding; spending on schemes through the new local growth fund in Wales will remain at the same level in cash terms as under the Shared Prosperity Fund in 2025-26 (£210 million). However, despite Wales retaining a higher-than-population share of spending, this appears to be lower than what Wales would have received under the previous EU schemes per year.

At the Welsh Labour party conference in 2023, Keir Starmer had promised to return control over the funds to the Welsh Government. The Spending Review states that the Wales Office will work with the Ministry of Housing, Communities and Local Government to implement the new local growth fund in Wales, with a vague commitment of “working in partnership with the Welsh Government”.

Disappointment on reforms to Borrowing Powers and Budget Flexibilities

One particularly disappointing element of the Spending Review was the absence of any changes to Wales’ Fiscal Framework. Specifically, the limits placed on the Welsh Government’s budget management tools and borrowing powers remain unchanged in cash terms since they were set at their agreed levels in December 2016.

Inflation has significantly reduced these strict, fixed limits. For example, the current overall capital borrowing limit for Wales is £1 billion. Even simply adjusting this in line with inflation since 2016-17 would have increased the Welsh Government’s borrowing capacity by more than £343 million.

The UK Labour Manifesto in 2024 conceded that the Welsh Fiscal Framework was “out of date”. The Statement of Funding Policy also outlines how the Scottish Government’s borrowing and budget management powers now grow in line with inflation. In that light, a Spending Review that entirely ignores the issues is disappointing and significantly hampers the Welsh Government’s ability to properly manage its budget.

The current system of occasional, ad-hoc flexibilities afforded to the Welsh Government in terms of reserve limits and drawdowns – at the Treasury’s discretion – is simply inadequate for a democratically elected government with substantial tax and spending powers.

Conclusion

The Spending Review has provided a clearer picture for public spending in Wales over coming years.

Given the likely growth in NHS spending over coming years, the scope for big additional spending commitments in party manifesto plans remains limited – unless of course, they leave open the possibility of using the Welsh Rates of Income Tax to raise additional revenue.

The big lesson from the last decade of budgets is that spending plans change – successive Chancellors have eventually topped up budgets between Spending Reviews, while higher inflation or increasing cost or demand pressures can blow spending plans off course. But the fiscal constraints the UK public finances face are real, in the context of the Chancellor’s “iron-clad” fiscal rules and the promises of no further major tax increases.

The task for the Welsh Government – along with all Welsh parties ahead of the election – will now be to determine their own spending priorities and face up to some of the difficult decisions that the outlook points towards.

[1] In contrast, at the time of the 2021 Senedd Election, block grants beyond that year (2021-22) had not been set and were not confirmed until later that Autumn.

[2] The Spending Review documents state that the block grant will grow by 0.7% per year in real terms on average. However, this is after the Block Grant Adjustments to account for tax devolution have been applied.

[3] In this scenario, the outlook for these services would significantly worsen if devolved taxes do not grow as quickly as forecast relative to block grant adjustments.

[4] This assumes the Welsh Government would ‘pass on’ consequentials to the Welsh NHS.

[5] These calculations – alongside Figure 1 – makes several adjustments to account for additional funding for public sector pension and National Insurance Contributions costs, funding for post-EU spending schemes and IFRS16 accounting changes.

- December 2025

- November 2025

- October 2025

- September 2025

- June 2025

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Reform UK

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections