Income inequality and the 1% in Wales – an analysis of taxpayer data

31 March 2017

This article was written by Guto Ifan. Guto joined the Wales Governance Centre at Cardiff University as a research assistant on the Government Expenditure and Revenue Wales (GERW) project, analysing public finances in Wales.

Given the shattering, generation-shaping magnitude of the great recession, it’s not surprising that interest (and anger) about inequality has returned with a vengeance. From the slogans of the Occupy movement, to Thomas Picketty’s best-selling 700-page Capital in the Twenty-First Century, inequality once again features prominently in public discourse.

Over recent decades, a large body of evidence has confirmed a remarkable rise in the share of income and wages taken by those at the very top of the income distribution in many countries,[1] echoed by the popular attention paid to the richest “1%”.

But what about income inequality in Wales? What are the characteristics of the “1%” in Wales? And how does the income distribution in Wales compare with the rest of the UK?

One source of data which can provide an important (albeit incomplete) insight into inequality and the income distribution in Wales is HMRC’s Survey of Personal Incomes. [2] (Importantly, the data doesn’t include those not earning sufficient income to start paying income taxes, thereby excluding a significant portion of the workforce and general population).

This blog presents an initial “under the bonnet” look at detailed survey data of the 1.3 million income taxpayers in Wales.

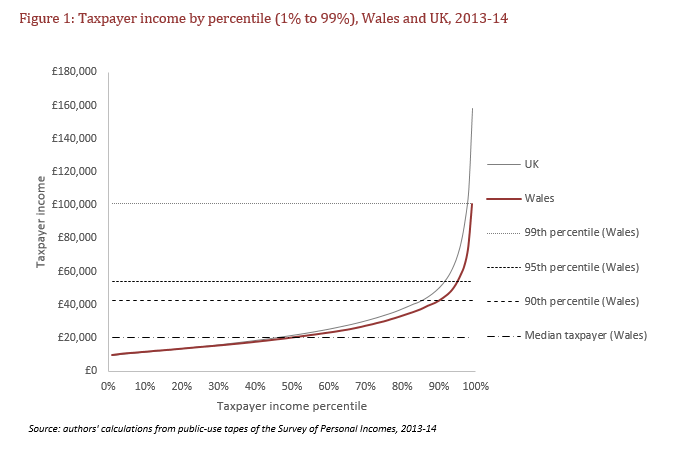

Figure 1 presents the percentile points of the income distribution of taxpayers in Wales and the UK as a whole.

Although the income of the median taxpayer in Wales (of £20,300) is similar to that of the UK as a whole, income differences between Wales and the UK begin to widen above this point.

Earning over £42,600 a year would put you in the top 10% of income taxpayers in Wales. Of these top 10% of income taxpayers in Wales, only one in four are women. In contrast, the top 10% of all UK taxpayers earn over £50,600. The data therefore suggests the incomes of taxpayers in Wales are more equally distributed than the UK as a whole. The ratio between the incomes of the 90th percentile of taxpayers over the 10th percentile (90:10) is 3.7 in Wales, but 4.3 across the UK as a whole.

If you are lucky enough to have a six-figure salary in Wales, you are probably in the “Welsh 1%”. In 2013-14, the top 1% of taxpayers in Wales earned over £100,100, while you would have needed to earn almost £159,000 to be in the top 1% of UK taxpayers. Of those classed in the top 1% of UK taxpayers, only around 1.3% (just under 4,000) live in Wales, compared with around 4.4% of all UK taxpayers generally. Of this group of taxpayers in Wales, only one in six are women.

Moving even further up the income distribution, the top 0.1% of Welsh taxpayers earned over £231,700 – significantly below the almost £650,000 you needed to earn to be in the top 0.1% of all UK taxpayers.

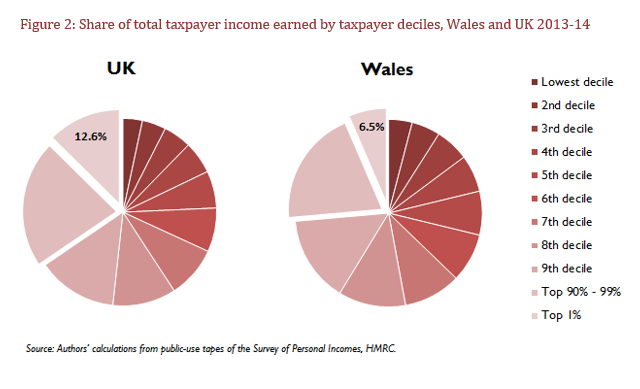

Figure 2 shows the share of total taxpayer income in Wales and the UK earned by each income decile. Each segment represents the income earned by 10% of Welsh and UK taxpayers (starting from the poorest 10%), while the top decile has been further split in two groups – the top 90% to 99% of taxpayers and the top 1%.

The top 10% of taxpayers across the UK earned 34% of total taxpayer income in 2013-14, a greater share than the 32% earned by the bottom 60% of taxpayers. Meanwhile, the top 10% of Welsh taxpayers earned 26% of total taxpayer income in Wales.

The top 1% of income taxpayers in the UK earned around 12.6% of total taxpayer income. Contrastingly, the top 1% of taxpayers in Wales earned only 6.5% of total Welsh taxpayer income. In other words, Wales’ highest earners took a smaller slice of a smaller pie.

Bell and Van Reenan[3] note the prevalence of high earners of the financial sector in the top 1% of UK income earners. Excluding London (and its large financial centre) from the analysis, the share of taxpayer income taken by the top 1% of income taxpayers falls to 10.5%.

The large inequality in taxpayer incomes in the UK described above means that income tax revenues have become more dependent on a smaller and smaller pool of taxpayers. Around 28% of total income tax revenue across the UK came from the top 1% of taxpayers, while the top 10% of taxpayers contributed 58%. UK newspapers like to complain about this heavy and unfair tax “burden” placed on the very rich, though it mostly reflects the larger share of pre-tax incomes taken by these taxpayers to begin with. Income tax revenue raised in Wales is less dependent on those on high incomes, although the top 1% of Welsh taxpayers still contributed 16% of the total, and the top 10% paid in 44%.

Understanding the size, nature and distribution of the Welsh income tax base will become even more important when a £2 billion share of income taxes gets devolved to the Welsh Government from 2019-20. With its powers to set income tax rates for the first time, the Welsh Government will be able to directly influence post-tax incomes and levels of inequality in Wales. However, the new powers may prove to be a rather blunt instrument: unlike in Scotland, powers to set thresholds for different rates will remain reserved to Westminster. Perhaps using existing powers over Council Tax, which takes a much greater share of income from poorer households, should be first in line for reform.

Data source:

HM Revenue and Customs. KAI Data, Policy and Co-Ordination. (2016). Survey of Personal Incomes, 2013-2014: Public Use Tape. [data collection]. UK Data Service. SN: 8044, http://doi.org/10.5255/UKDA-SN-8044-1

[1] For example, see Atkinson, A., Picketty, T, and E Saez (2011). Income Inequality in the Long Run. Journal of Economic Literature. 49 (1): 3-71

[2] It should be noted that due to a relatively small sample of Welsh taxpayers, there is a high degree of uncertainty in these estimates. Furthermore, strong assumptions must be made in allocating the incomes of some very high income individuals to Wales, as some high earners are pooled together in the data for anonymity purposes.

[3] Bell, B.D. and Van Reenen, J. (2013). Extreme Wage Inequality: Pay at the Very Top. The American Economic Review. 103 (3): 153-157

Comments

1 comment

Comments are closed.

- December 2025

- November 2025

- October 2025

- September 2025

- June 2025

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Reform UK

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections

Presumably this is simply reported income in as much any income from Isas for example is not required on returns , so I could be in receipt of a very small amount of pay but receive a very large amount from the tax shelter .