Frozen 2: Tax Freezes, the 2-Child Limit (and what the 2025 Autumn Budget means for Wales)

27 November 2025

By Guto Ifan, Ed Gareth Poole and Owain Cynfab

On Wednesday, Chancellor Rachel Reeves delivered her second budget, after months of speculation, briefings and uncertainty.

The much-trailed worsening of economic forecasts turned out to be slightly less consequential for the public finances than originally thought. As expected, the Office for Budget Responsibility (OBR) downgraded their assumptions on future productivity growth in the UK economy, but this was more than outweighed by an upgrade to economic growth in 2025, higher inflation and higher wages boosting forecast revenues. Underlying forecasts left borrowing just £6 billion higher in 2029-30, driven by higher local authority, welfare, and debt interest spending.

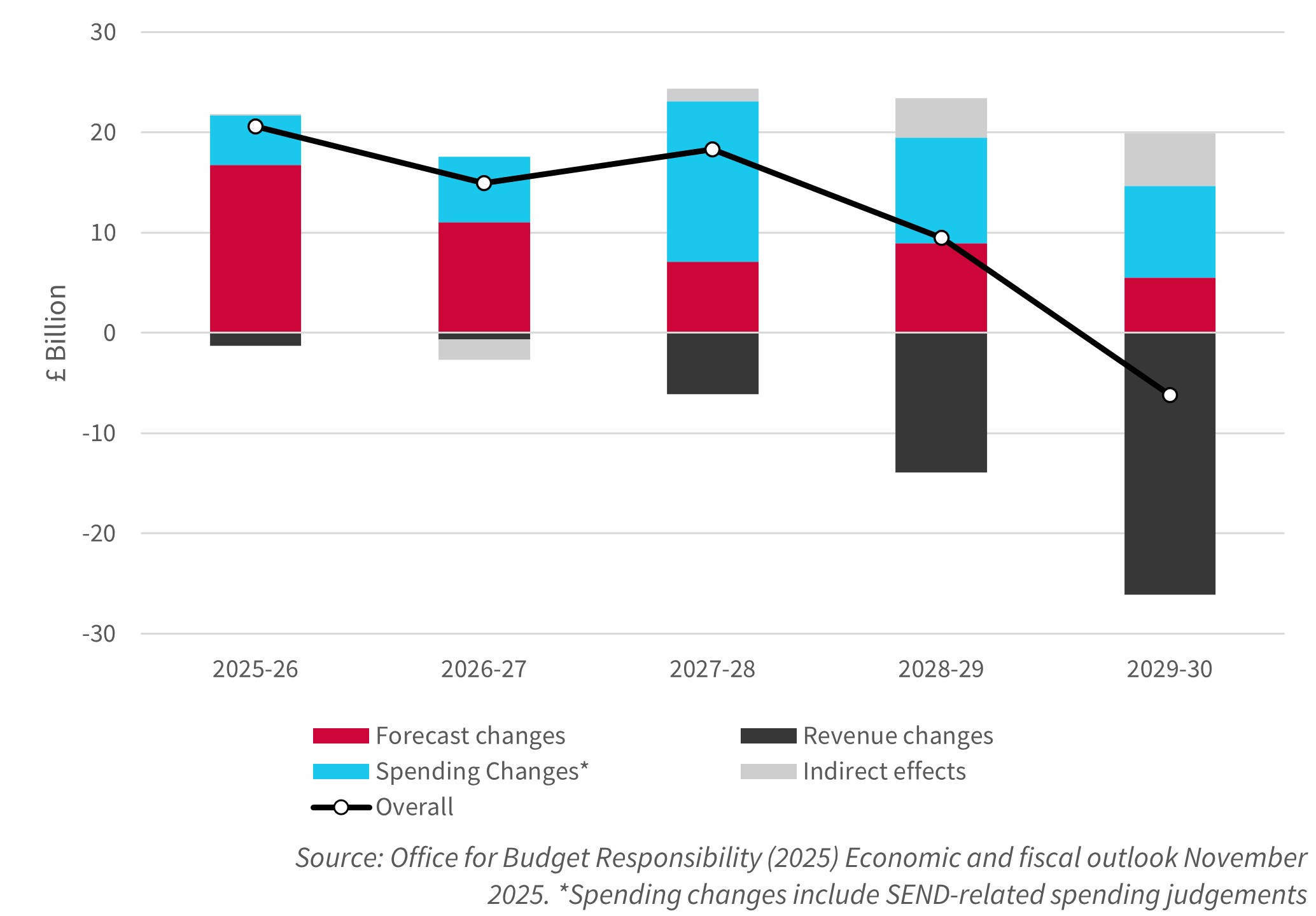

The U-turns on welfare spending cuts announced over the summer were accompanied by a removal of the two-child benefit limit and some cost-of-living measures to reduce energy bills. But the main story of this Budget was the wide array of tax increases scheduled for the later years of this Parliament, which, as shown in Figure 1, reduce borrowing in the last year of the forecast.

These have increased the Chancellor’s ‘headroom’ against her fiscal targets to £22 billion, leaving the Treasury slightly less exposed to forecast uncertainties next year.

Figure 1: Public sector net borrowing: changes since March

For Wales, we expect both the welfare spending increases and the main tax increases to have a disproportionate impact relative to the UK as a whole.

Further front-loaded funding for the Welsh Government budget was also announced, driven mainly by Business Rates measures in England. But despite further good news in the devolved tax forecasts, the UK government’s medium-term spending plans point to a darkening fiscal outlook for the next Senedd term.

Tax policies

Overall, this budget increased taxes by £26 billion by 2029-30, a hike which follows hard on the heels of the £32 billion raised at last year’s budget.

The headline tax change announced by the Chancellor was a further three-year extension to the freeze on personal tax thresholds through to 2030-31. The freeze had been pencilled in to end in April 2028, after which thresholds would again rise in line with inflation. But once the more progressive policy decision to raise income tax rates by 2 percent was reportedly shelved, freezing thresholds became the only means by which the Chancellor could raise sufficient tax receipts without a direct break of Labour’s manifesto commitments to not raise the headline rates of income tax, National Insurance contributions or VAT.

Freezing tax thresholds means that more taxpayers enter the tax system or start paying tax at the 40p or 45p rate bands, a phenomenon known as ‘fiscal drag’. Had the personal allowance and higher rate threshold been allowed to increase in line with inflation since 2021, they would have been £4,900 and £20,100 higher by 2030-31. The extension to the freeze is expected to raise a further £3.3 billion in 2028-29 and £12 billion by 2030-31.

The fiscal drag effect is relatively stronger for Wales, as a larger proportion of Welsh taxpayers are drawn into the basic, higher and additional bands than for the UK as a whole. Already this year, 65% of Welsh adults will pay income taxes, up from 53% a decade ago, and the share of Welsh adults in higher and additional rate bands has trebled from 1999 (from 3% to 9%).

Our rough estimations suggest that the continued freeze will result in an additional 1.5% of Welsh adults being dragged into the basic rate in 2029, compared with just 0.3% across the UK as a whole.[1] We expect the extension of the income tax threshold freeze to disproportionately squeeze Welsh household incomes – but some of that additional tax raised from households will go to boost the Welsh Government budget (as set out below).

Beyond the big personal tax increases, a range of smaller tax rises were announced. Taxes on savings, dividends and property incomes were increased by 2 percentage points.[2] National Insurance will also now be charged on salary-sacrificed pension contributions. The tax rate on remote gambling was increased from 21 percent to 40 percent, and the rate for online betting was increased from 15 percent to 25 percent from April 2027, measures forecast to raise £1.1 billion per year by 2030-31. There will however be no changes to taxes on in-person gambling and on horseracing, and bingo duty will be entirely abolished from its current 10 percent rate.

Electric Vehicles will be taxed for the first time via a mileage charge. Fuel Duty was frozen yet again, this time for a further five months through to September 2026. The Chancellor has pencilled in inflationary increases in fuel duty rates from April 2027, but the OBR warns of the risks to the forecast, since “previously announced increases to fuel duty rates have now been postponed for 16 consecutive years” and “the total cost of fuel duty freezes from 2010-11 to 2026-27 has risen to £120 billion”.

For England, the Chancellor announced a High Value council tax surcharge from 2028. This surcharge will be a flat £2,500 levy on properties worth more than £2 million and £7,500 on properties worth more than £5 million. Revenues will go to central government rather than local government, which might lead to a situation where revenues could boost spending in Wales, Scotland and Northern Ireland, where the tax won’t apply.

The lack of a proper revaluation of all properties in England and the cliff edges created by this new tax leaves a lot to be desired in terms of tax design. From a Welsh policy perspective, this should trigger a conversation ahead of the Senedd election and planned forthcoming revaluation around how to do something more sensible on property taxation in Wales.

Spending decisions

The largest policy measure requiring new spending was the removal of the two-child benefit limit. Given the upfront cost of this policy (£2.3 billion in 2026-27 and £3.0 billion in 2029-30), it had been previously resisted by the Treasury, but the cost effectiveness of the measure in reducing child poverty proved too great to ignore.

Given the recent history of increasing child poverty rates, previously set to be 32 per cent of all children in the UK in 2025-26, a policy that is estimated to lift 450,000 children out of poverty is hugely welcomed.[3] The Welsh Government estimates that the removal will benefit some 70,000 children in Wales and lead to a three to four percentage point reduction in relative child poverty rates.[4]

The Chancellor also announced a measure to cut energy bills for households for the next three years, through directly part-funding the domestic share of the Renewables Obligation. This will reportedly save a typical household £127 next year. However, Wales currently does relatively well out of the Energy Company Obligation spending which is being scrapped, and this may lead to less money being invested in making Welsh homes more energy efficient.

Implications for the Welsh Government budget

The headline announcement for the Welsh Government budget was £508 million of Barnett consequentials over the current Spending Review period. Of this, £322 million is for day-to-day spending and £186 million is for capital spending.

When announcing these Barnett transfers to Wales, Scotland and Northern Ireland – and via some apparent banter directed towards the SNP – the Chancellor implied that the additional funding was being provided for the Scottish Government “because Anas Sarwar asked us to”. This was the latest in a long line of utterances by UK ministers that contain misinformation about how the automatic, population-based transfers under the Barnett formula work. What’s also interesting here is that the Chancellor didn’t choose to give Welsh Labour leader Eluned Morgan credit for winning Barnett consequentials alongside her Scottish Labour counterpart.

Table 1: Autumn Budget 2025 consequentials for the Welsh Government (£m)[5]

| 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 | Total | |

| Resource Block Grant | 27 | 186 | 114 | -4 | 322 | |

| Capital Block Grant | 14 | 120 | 2 | 50 | 186 | |

| Total | 27 | 200 | 234 | -2 | 50 | 508 |

| Of which (based on policy costings document): | ||||||

| Business Rates measures in England | -2 | 106 | 66 | 42 | 212 | |

As usual, no breakdown was provided of what spending measures in England triggered this additional funding for the Welsh Government.

Following the recent pattern, the additional funding is front-loaded (as shown in Table 1). Based on our analysis of the policy scorecard document, it appears most of the resource block grant funding has been triggered by Business Rates measures in England.

Some NHS England spending has been brought forward to earlier years, which provides the Welsh Government with some £25 million in both 2025-26 and 2026-27. But this is offset by lower funding from 2028-29 onwards as ‘savings’ are found in the NHS England budget.

Similarly, beyond the current Spending Review period, the UK government has pencilled-in significant reductions to spending, as it aims to find ‘efficiencies and savings’ worth £4.9 billion of day-to-day spending in 2030-31.

Putting aside the credibility and feasibility of this spending restraint, these pencilled in reductions in spending has significantly worsened the overall outlook for next Senedd term and the fiscal context for next year’s election.

With real terms growth in day-to-day spending slowing to 0.6% in 2028-29 and 0.5% in 2029-30, this would imply a difficult outlook for the next Welsh Government and cuts to non-priority spending areas.

Inflation and public sector pay

More immediately, the Welsh Government’s budget will also be impacted by the updated forecasts for inflation and pay growth over coming years. The OBR’s forecast for the GDP deflator measure of inflation now stands at 2.2% for 2026-27, some 0.5 percentage points higher than their forecast back in March. Economy-wide average earnings growth is also now set to be around 1 percentage point higher, at 3.2% in 2026-27.

This matters because the Welsh Government’s Draft Budget plans set out inflationary uplifts for each spending area and assumed the public sector pay bill would grow by 2.2% – leaving an unallocated pot of funding for any deals to get the budget through the Senedd.

The updated forecasts mean that the Welsh Government’s assumed inflationary uplifts are less generous than expected; for example, the planned real terms spending increase for the NHS (before any additional allocations from unallocated funding) is now just 0.3% in real terms. Across the budget, we estimate that providing enough funding for the public sector pay bill to increase by 3.2% instead of 2.2% would require an additional £90 million.

The Welsh Government’s devolved income tax bonus

In much better news, the extension of the income tax threshold freeze also has significant implications for the Welsh Government’s budget. The Welsh Government does not have the power to vary income tax thresholds (unlike the Scottish Government), so the UK Government’s freeze applies automatically to Welsh Rates of Income Tax (WRIT). As highlighted in our recent report, A Decade On: Reforming Wales’ Fiscal Framework, devolved Welsh income tax revenues have been growing more rapidly than the corresponding reductions to the Welsh block grant, primarily because of the fiscal drag effect.

Relative to the OBR’s March 2025 forecasts which informed the Welsh Government’s Draft Budget plans, the updated income tax forecasts provide £49 million more to spend in 2026-27 and £120 million more in 2028-29 (including projected reconciliations for forecast errors in previous years). This means the improved tax forecasts will boost day-to-day spending over the next four years by more than the consequentials announced yesterday.

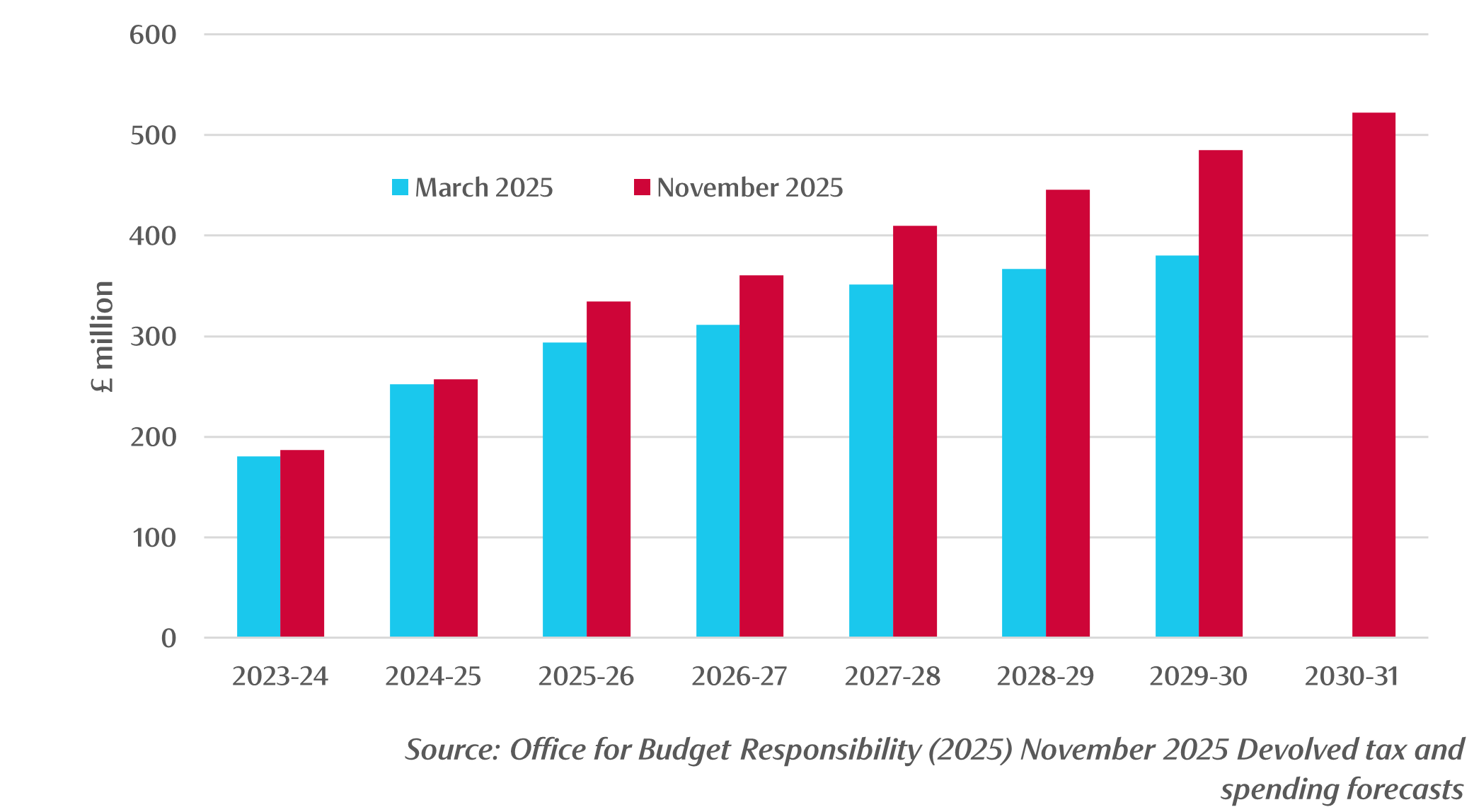

The total net effect of tax devolution on the Welsh Government budget next year is set to be £524 million, over 2% of day-to-day spending. The continued freezing of thresholds means the tax bonus will continue to grow until the end of the decade. The OBR notes devolved Welsh income tax receipts by 2030-31 will be 21.3 per cent higher as a result of frozen income tax thresholds since 2021, compared with 14.3 per cent for equivalent revenues in England and Northern Ireland.

Figure 2: Net effect of income tax devolution on the Welsh Government budget

Other Welsh-specific announcements

Most of the Wales-specific announcements had already been briefed before the budget: the decision that Wales should host two AI growth zones, supported by a £10 million investment in semiconductors, and that Wylfa had been chosen as the site for the UK’s first Small Modular Nuclear Reactor.

Outside of the main budget speech, the government also made some minor but useful amendments to Wales’ Fiscal Framework – specifically relating to the Welsh Government’s ability to borrow and manage its budget. In 2026-27, the Welsh Government’s annual and cumulative capital borrowing limits (£150 million and £1 billion respectively) will be increased by 10%, then uprated with inflation from 2027-28 onwards. Likewise, the overall limit on the size of the Wales Reserve (£350 million) and the annual limits for drawing down day-to-day spending (£125 million) and capital spending (£50 million) will also be increased by 10%, with inflation uprating from 2027-28 onwards. This is a welcome improvement in the position, though falls short of restoring the large inflationary losses to these limits since they were set in cash terms a decade ago.

Conclusion

After a turbulent 18 months, the substantial tax increases and larger fiscal headroom should provide greater policy stability and certainty over the next year. But this Budget also implies significant tax increases and spending cuts just before the likely date of the next UK General Election. The largely piecemeal approach to increasing taxes also represents a riskier way of raising additional revenues, as they concentrate losses on smaller groups of taxpayers. The commitment to restore public services within a tight spending envelope will also depend on achieving highly ambitious productivity and efficiency improvements.

For the Welsh Government, updated inflation and pay forecasts make this year’s budget trickier still, notwithstanding the additional consequentials and improved tax forecasts which increase the available funding to be allocated.

Looking further ahead, the backloaded tax increases and worsening outlook for public spending – if UK government plans are to be believed – also leave Welsh political parties with much to consider as they finalise manifesto plans ahead of next year’s election.

[1] Richiardi M, Collado D, Popova D (2021). UKMOD – A new tax-benefit model for the four nations of the UK. International Journal of Microsimulation, 14(1): 92-101. DOI: 10.34196/IJM.00231.

[2] This measure may also affect the Welsh Government’s income tax powers. The new category of property income will apply to the reserved portion of income taxes paid by Welsh taxpayers; but there is an indication that the Welsh Government may be able to set its own rate for property income tax in future.

[3] No half measures • Resolution Foundation

[4] https://www.gov.wales/written-statement-first-minister-response-removal-two-child-limit

[5] Taken from: https://www.gov.wales/written-statement-welsh-government-response-uk-autumn-budget-2025

- December 2025

- November 2025

- October 2025

- September 2025

- June 2025

- May 2025

- March 2025

- February 2025

- December 2024

- October 2024

- September 2024

- July 2024

- June 2024

- December 2023

- November 2023

- August 2023

- February 2023

- December 2022

- November 2022

- September 2022

- July 2022

- April 2022

- March 2022

- January 2022

- October 2021

- July 2021

- May 2021

- March 2021

- January 2021

- November 2020

- October 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- October 2019

- September 2019

- June 2019

- April 2019

- March 2019

- February 2019

- December 2018

- October 2018

- July 2018

- June 2018

- April 2018

- December 2017

- October 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- Bevan and Wales

- Big Data

- Brexit

- British Politics

- Constitution

- Covid-19

- Devolution

- Elections

- EU

- Finance

- Gender

- History

- Housing

- Introduction

- Justice

- Labour Party

- Law

- Local Government

- Media

- National Assembly

- Plaid Cymru

- Prisons

- Reform UK

- Rugby

- Senedd

- Theory

- Uncategorized

- Welsh Conservatives

- Welsh Election 2016

- Welsh Elections