The China-US Trade War – Where Next?

18 June 2019

Written by Mike Wilson & Katy Huckle

The Belt and Road Initiative and Trade Wars

We recently published a blog post by PARC’s own Professor Peter Wells on the Belt and Road Initiative (BRI), or the One Belt One Road (OBOR) as it is sometimes referred to. As it grows and develops, the BRI continues to divide and create factions between East and West, and in this post we address the implications of those factions and the potential global impact of an escalating trade war.

So what is the purpose of the Belt and Road Initiative? With the on-going standoff between China and US, is the BRI simply a way for China to preserve its economic growth by opening up new trade routes and markets (a necessary defensive precaution against US trade tariffs)? Or is it, combined with the Made in China 2025 initiative, actually part of a full frontal Chinese assault, in its bid to become the world‘s most powerful economy?

What is the Belt and Road Initiative?

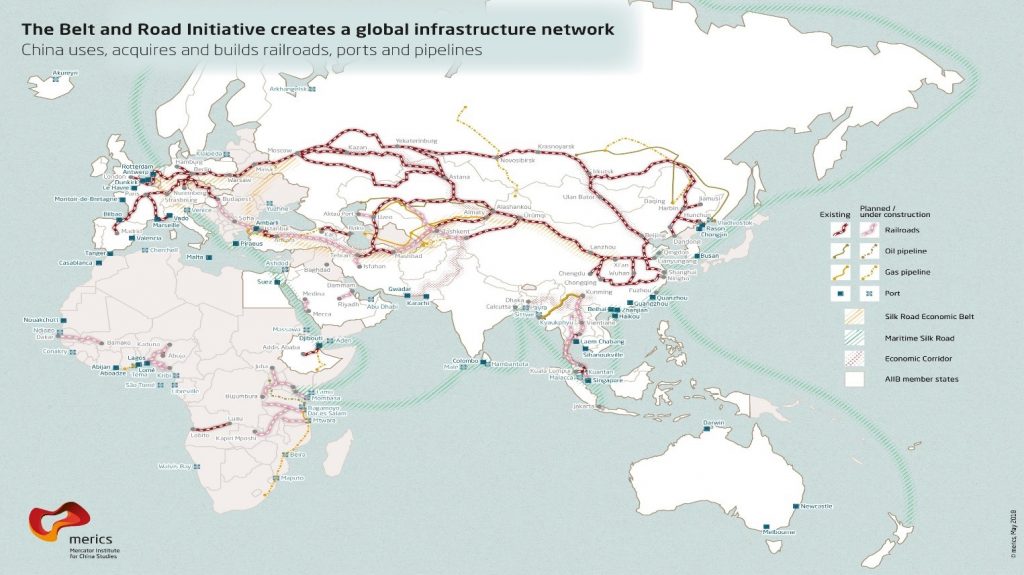

Let’s start with a deeper look at the BRI and some of its implications. Firstly, we must remove a common misconception – the BRI is not a repackaging of the Eurasia land bridge, or the Trans-Siberian rail connection from China into Eastern Europe. It is much more than that. The BRI is an initiative started by China in 2013 to expand and open up new routes of international trade. To date, 125 countries have signed up to the BRI and total projected investment lies somewhere between $6 and $10 trillion.

Whilst comparisons have been made to the old ‘Silk Roads’, the BRI encompasses land, maritime and pipelines to facilitate trade expansion, reaching well beyond that of the original silk roads. The Main Axis of the BRI includes Central, East, West and South Asia. The Indian sub-continent, the Middle East, Africa and Europe are known as The West Wing, with Italy attracting huge media coverage in late March when they become the first G7 country to sign up to the BRI. In 2018 the BRI scope grew further to include Central and South America, thereafter The East Wing, with Panama being the first East Wing country to sign up.

To enable the construction of the BRI, China has financed many initiatives across Asia and the Middle East; including ports, railways and other construction projects. These projects have incurred recent criticism, often described as a sinister move by China to entrap and indebt vulnerable nations whilst expanding its network.

China and Chinese Capital have been top of Foreign Direct Investment lists for many years, and the cost of capital often involves the issuance of work visas in order for Chinese citizens to work directly in Asia, Africa, Latin America and Eastern Europe. By all appearances, China wants to credit its way to economic growth, and has been doing so for many years.

Made In China 2025

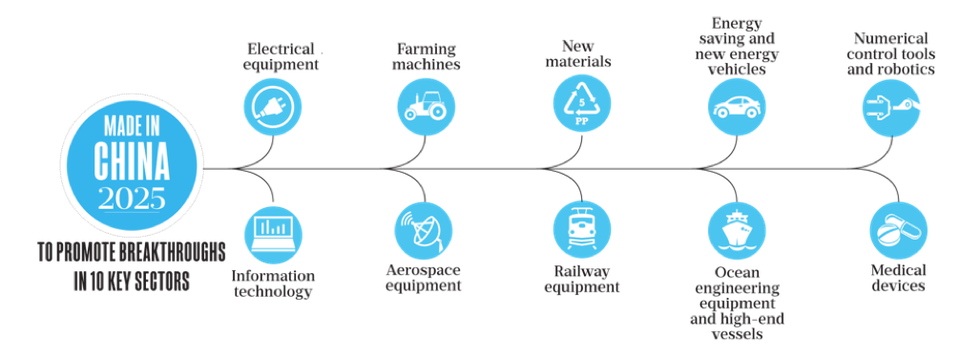

The ‘Made in China 2025’ initiative is the vision that China will be the leading economy in a number of advancing technologies, which directly opposes current US dominance in manufacturing and tech, prompting an extreme reaction from the United States and its leadership. It is a 10-year project with an enormous budget of up to $US 300 billion; and its purpose is to increase the propensity of Chinese brands on the global market, whilst improving product quality and innovation. Under Made in China 2025, more and more products will be designed and assembled in China, concentrating initially on the 10 below industries:

East vs West?

The ongoing Trade War between China and the US kicked into a new gear after the blacklisting of Chinese telecoms provider ZTE in 2018, and has now escalated further with the US attack on telecoms giant Huawei. Huawei, a leading world provider of telecoms equipment, has been accused of numerous security breaches, including espionage. However, it is difficult not to view this escalation as simply another battleground in the American Chinese Trade War.

The United States has identified the increasing Chinese economic power as a major threat to their own economic might, and has also accused China of unfair competitive practices, facilitated by Chinese government-backed financing. The US is very wary of China’s ‘relaxed’ approach to intellectual property, and it has also accused China of currency manipulation. These accusations have helped enable the US to justify its somewhat extreme measures against Chinese products in recent months. As far as the US is concerned, it’s time to fight back.

And, with actual warfare (thankfully) out of the question, the next best option open to the United States is trade warfare. The timing is ideal, as the cost of production in China has risen dramatically in recent years, in line with the increasing cost of Chinese labour. It’s no longer a cheap, underdeveloped country that Western organisations can put to use as a factory. Western organisations are now looking to relocate their manufacturing facilities either to cheaper shores, such as South East Asia, or back to the point of consumption where automation can keep down costs. A feeling of nationalism and protectionism was already brewing, and Trump‘s “America First” mandate managed to capture that sentiment.

But the knock-on effect we see today has much bigger implications than just the US vs China. The world‘s two largest economies cannot enter into a trade ‘Cold War’ without there being a major impact on the rest of the world. What will that impact be? It’s still too soon to say, but as China continues to build up the BRI, and the US flexes its muscles as the (current) largest supplier and customer to most global markets, will we see a world split into sides… East versus West?

Trump’s Trade War and Telecoms

Trump’s blockade of ZTE and Huawei, which includes the banning of US products into Chinese equipment, could be the first indication of an entire industry split between East and West. New Zealand and Australia have already followed Trump‘s suit by banning Chinese telecom equipment. Parts of Western Europe are still in intense debate about whether or not to impose a ban, which will not be an option for any of the Eastern European countries that have already bought into BRI.

It is difficult to imagine a complete global deterioration into an either/or situation between the East and West. We live in a global economy where billions of products are produced halfway around the world from the point of consumption. Surely we cannot draw a solid line between East and West that those products cannot cross? However, if we extrapolate from the telecoms industry, whereby China will now slowly be forced to design and manufacture their own semi-conductors and electronic hardware, then we could be looking at two distinct telecom industries (East and West) or even two separate internet set-ups, which will not only be more costly but also more divisive in a globally connected world.

Troubled Times for China?

It certainly doesn’t look like it. Whilst the ongoing trade tariffs and blockades on US components is an inconvenience right now, China is far from in trouble – in fact, if China can execute its plan, it will be cemented as potentially the most powerful economy on Earth. How the West will react over the coming decades remains to be seen. China’s investment along the BRI and in to Eastern Europe definitely throws up some interesting and potential conflicts. Whilst trade tariffs and closing borders are protectionist measures, they are extremely counter-intuitive to the global need for innovation, development and collaboration as we progress towards Industry 4.0 and, eventually, a 5G-enabled, IoT world.

- Disruptions to Global Supply Chains, Sustainability, and the Inventory Time Bomb

- Sustainability is Driving New Business Dynamics – Repurposing and Connected Collaboration Across Supply Chains

- Digital Technologies – Poison and Medicine for ReMakers

- RemakerSpace reshapes the future

- If they haven’t already, the coronavirus will force companies to re-think their elongated supply chain.